Markets Are Focused on the FED

Markets Are Focused on the FED

The precious metals complex traded in a broad consolidation pattern last week in front of this week’s pivotal interest rate decision from the US Federal Reserve (FED).

Physical Gold priced in USD traded in the upper half of the post-election range but was unable to overcome resistance at $2725.00 early in the week and drifted lower to end the week fractionally higher at $2648.00.

The fact that the yellow metal traded above the 30-day moving average at $2640.00 during every trading session adds to the bullish technical outlook.

Gold denominated in AUD reached a new all-time high of $4270.00 on Wednesday and finished the week 1.1% higher at $4158.00. As long as the $4110.00 support line holds, the path of least resistance looks to be higher.

Physical Silver underperformed Gold last week, with USD based Silver slipping 1.3% to $30.55 and Silver priced in AUD ending the week pretty much unchanged at $47.97.

The Gold versus Silver ratio spiked back to the 87.00 handle midweek but reverted back below 86.50 to retain the downward near-term bias.

Based on the recent policy moves from other G-10 central banks, there is a high probability that the FED will lower the FED Funds target by 25 basis points (BP) to 4.25 to 4.50%

The Swiss National Bank and the Bank of Canada delivered 50 BP rate cuts last week, and the European Central Bank cut by 25 BP.

As such, the monetary easing cycle from G-10 central banks looks set to be carried into next year.

The Reserve Bank of Australia remains on hold and last week’s stronger than expected employment report dampened speculation of a cut in Q1 2025.

The US CPI was in line with expectations. With the headline rising for the second consecutive month, and alongside the PPI components, the PCE deflator is also expected to rise.

Still, financial markets are confident the FED will cut rates at the conclusion of the FOMC meeting on December 18.

Some financial commentators suggest the risk of a “hawkish” cut with less rate cuts next year than anticipated in September in the Summary of Economic Projections.

The recognition that the US economy is stronger than it had expected previously, and that inflation is on a bumpy path will allow the FED to be patient.

By FED chief Jerome Powell’s own admission, the US economy is stronger than he thought in September, when they cut rates by 50 bp and signaled the likelihood of two more quarter point cuts this year.

Employment growth bounced back after the recent weather distortions, the revisions were better and average hourly earnings rose.

The unemployment rate ticked up to 4.2%, which is the average for the second half of 2024. The Atlanta FED’s GDP tracker points to 3.3% growth this quarter, and last week, we learned that the headline CPI rose for the second consecutive month.

With the US macro data firming above the FED’s own expectations, there has been some commentary that suggests the FED may hit the pause button on lowering rates early in 2025.

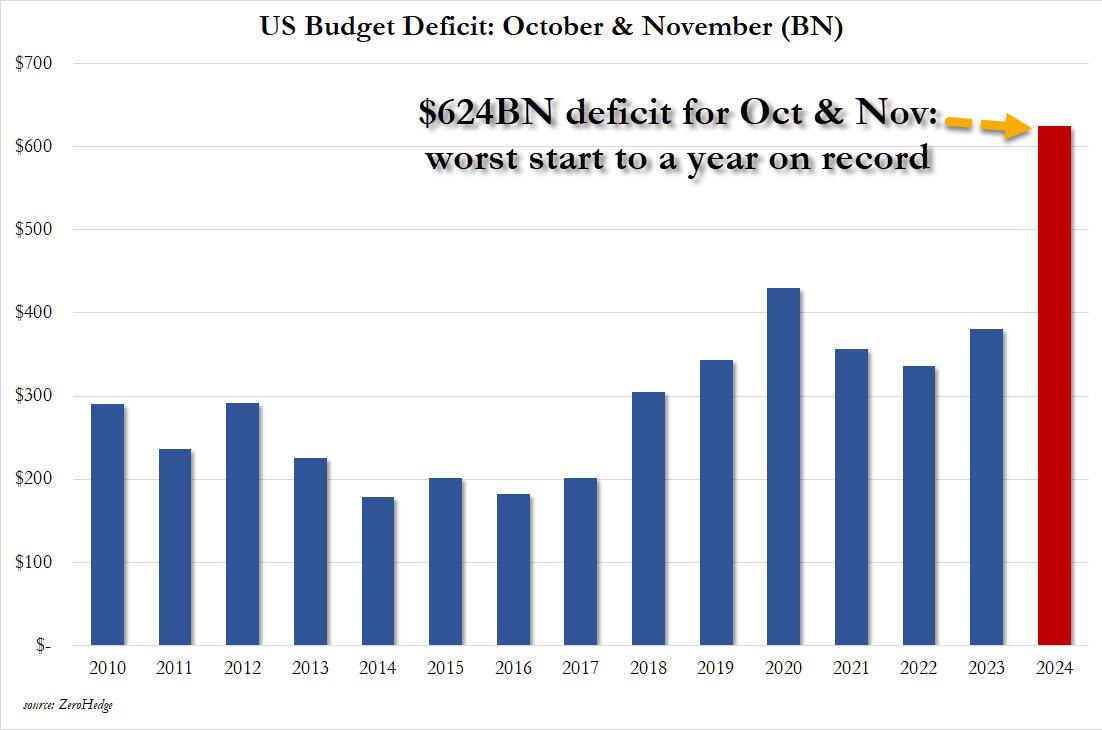

This may be the case but, as illustrated on Chart 1, a growing deficit may force the FED to accelerate the easing cycle.

Chart 1 shows that in October and November, the US deficit exploded to a staggering $624.2 billion.

Worse, combining October and November we find that not only was the combined number of $624 billion some 64% higher than the corresponding period one year ago, but it was also the highest deficit on record for the first two-months of the fiscal year, including the spending during the covid crisis.

Putting the deficit in context, the budget deficit in October and November, the first two months of fiscal 2025, are now officially the worst start a year for the US Treasury on record.

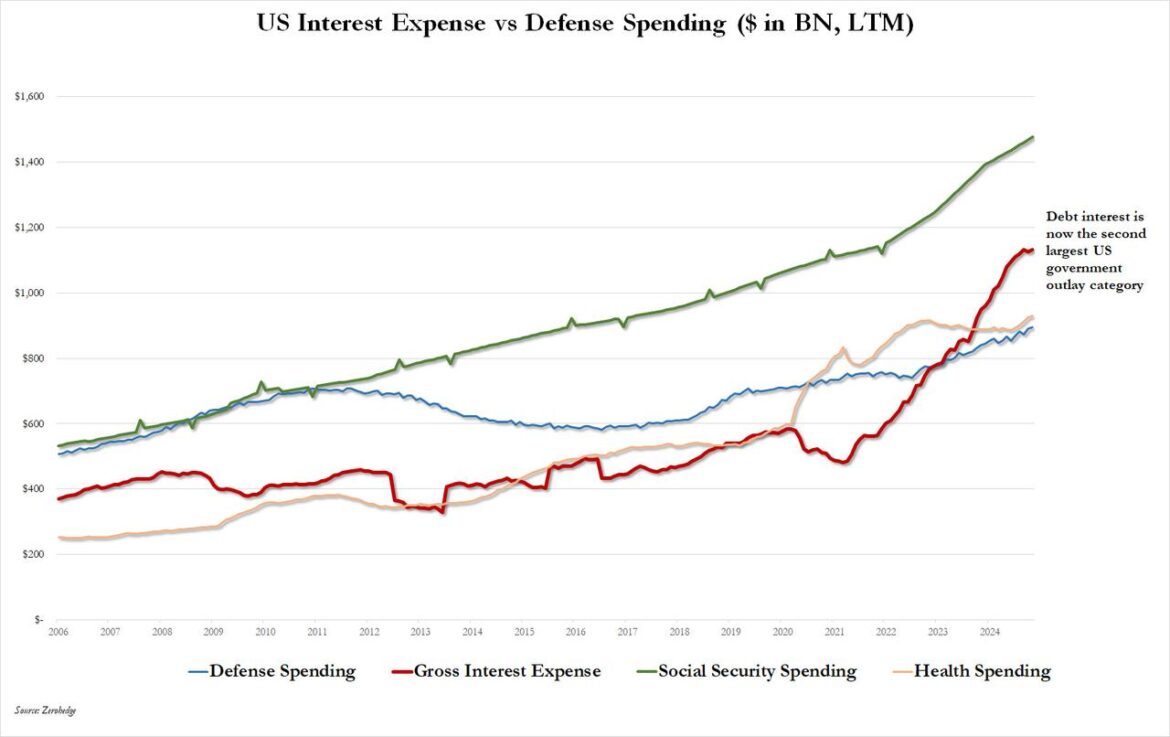

Not surprisingly, as shown on Chart 2, this blowout in the deficit will add upside pressure on the US interest payments.

In fact, some reports have estimated that the deficit payment for December could be more than $150 billion.

With gross government outlays, deficits and deficit repayments at the highest levels they have even been, it’s no wonder that investors of all levels of size and sophistication are turning to the safety and security of physical Gold and Silver.

Gold and Silver have a time proven track record of providing a long term store of value for a portfolio during economic uncertainty.

Now is the time for provident investors to consider adding more hard assets as the cornerstone of their generational wealth creation strategy.

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.