Stagflation is Bullish for Gold and Silver

Stagflation is Bullish for Gold and Silver

Since the US Federal Reserve (FED) lowered their Fed Funds target by 50-basis points on September 18th, financial markets have been viewing US economic reports through a prism of how the incoming data could impact near-term monetary policy.

The combination of last week’s stronger inflation readings and rising weekly jobless claims lifted US interest rates, the US Dollar, and dampened the rally in the precious metals complex.

Several FED officials spoke to the press, and it didn’t appear that the employment or inflation reports changed their views as much as it had impacted global capital markets.

The September Summary of Economic Projections found that 10 FED members said a further 50-basis points of cuts in Q4 would be appropriate, but seven thought 25-basis points would be enough for the remainder of 2024.

After drifting down to initial support near $2600.00, USD-based Gold rallied to reclaim the $2660.00 level and finished the week fractionally lower at $2657.00.

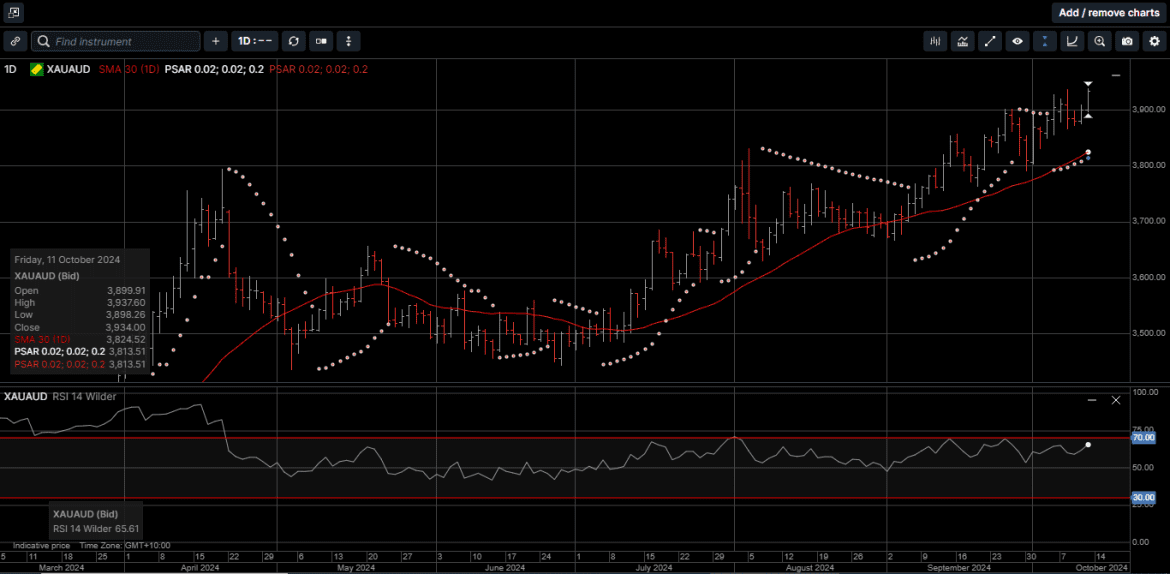

With the AUD/USD sliding by 1.3% last week, Gold denominated in AUD posted a new all-time high at $3937.00 and a new all-time weekly close at $3934.00.

The technical picture for physical Gold in both currencies continues to look robust with current prices well above the 30-day moving averages of $2582.00 and $3824.00, respectively.

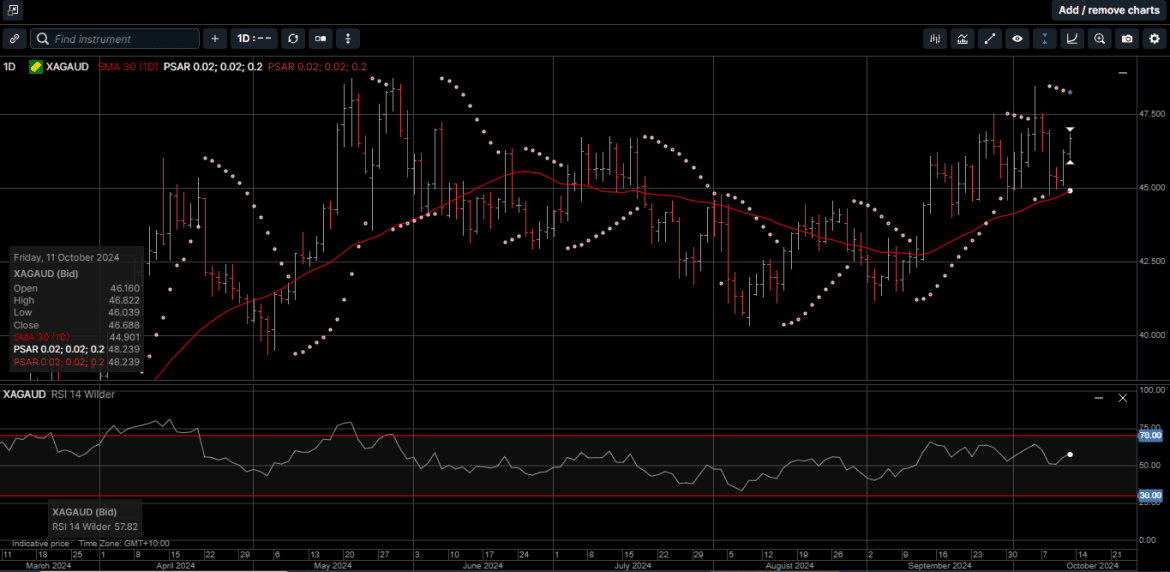

Physical Silver prices underperformed Gold last week as the weaker growth thematic from last week’s macro data weighed on the industrial demand aspect of the metal.

Silver priced in USD slipped 2.1% to $31.50, while AUD-based Silver dropped by 3.8% but held above the $46.50 level.

Like Gold, physical Silver in both currencies are trading above their 30-day moving averages of $30.52 and $44.58, respectively.

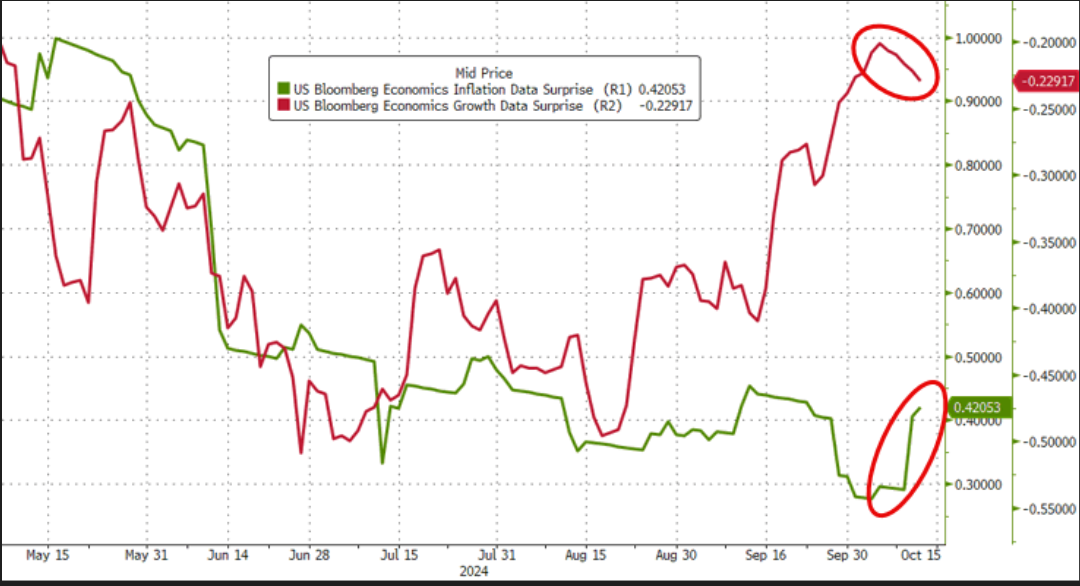

As illustrated on Chart 1, the economic condition known as Stagflation, which is the nemesis of every central banker, is now clearly back in the mainstream economic narrative.

The term stagflation was first used during the 1970’s oil crisis and is a portmanteau of the words “stagnation” and “inflation”

The reason that stagflation is a problem for central bankers is that a stagnate economy needs to be stimulated by lower interest rates.

But as we know, lowering interest rates while inflation is rising will just make inflation rise faster.

Stagflation has been a theme all year but recently it has become so much more pronounced that not even the most vocal government sycophants can ignore it.

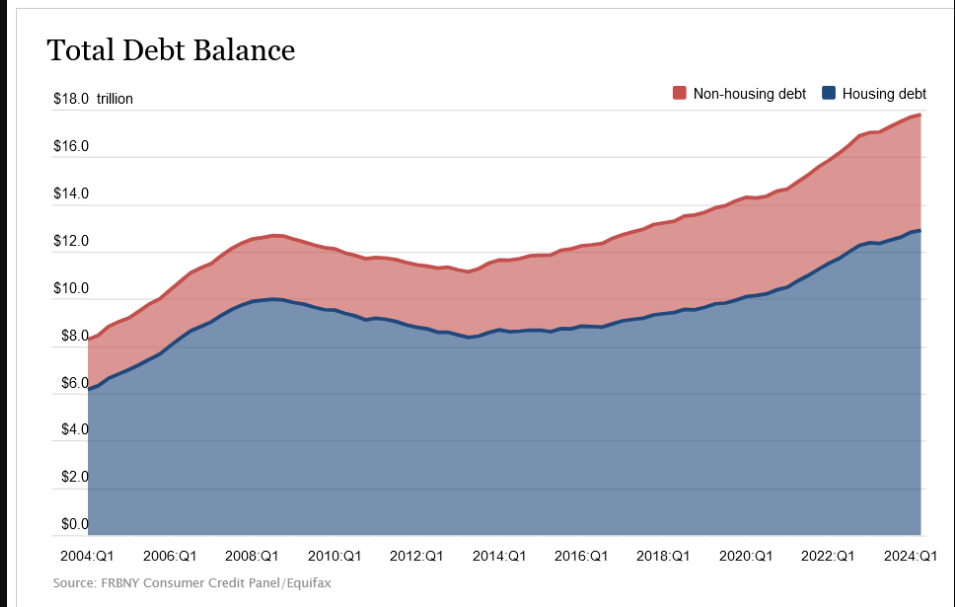

One of the most effective methods of reducing US stagflation is to stimulate non-inflationary economic growth. It’s important to remember that 65% of the US GDP is based on Retail Sales.

However, as shown on Chart 2, with US total consumer debt pushing up to almost $18 trillion, it is difficult to imagine that US consumers are willing to push their credit limits much further.

During previous episodes of economic stagflation, central bankers have always caved in to the higher inflation risk and lowered interest rates to avoid a recession, which has been bullish for Gold and Silver.

While short-term market fluctuations may cause concern, physical Gold and Silver’s status as a hedge against inflation and currency devaluation remains unchanged.

As such, provident investors, who are looking for a long-term wealth creation strategy, should consider utilizing a dollar-cost averaging plan to capitalize on buying opportunities presented by short-term price pullbacks in the most secure form of money: physical Gold and Silver.

Chart 1 Stagflation:

Chart 2 US Consumer debt:

Chart 3 Gold AUD:

Chart 4 Silver AUD:

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.