Gold Reaches New Highs in Front of US Elections

Gold Reaches New Highs in Front of US Elections

With less than two weeks until the US Presidential election on November 5th, intraday price volatility has risen across a range of financial markets.

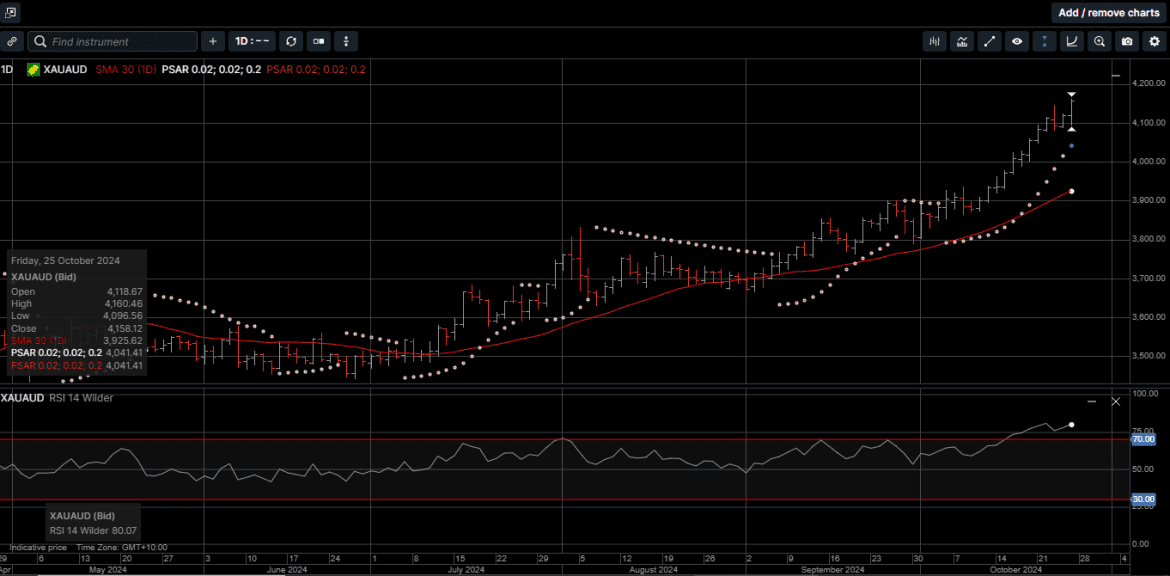

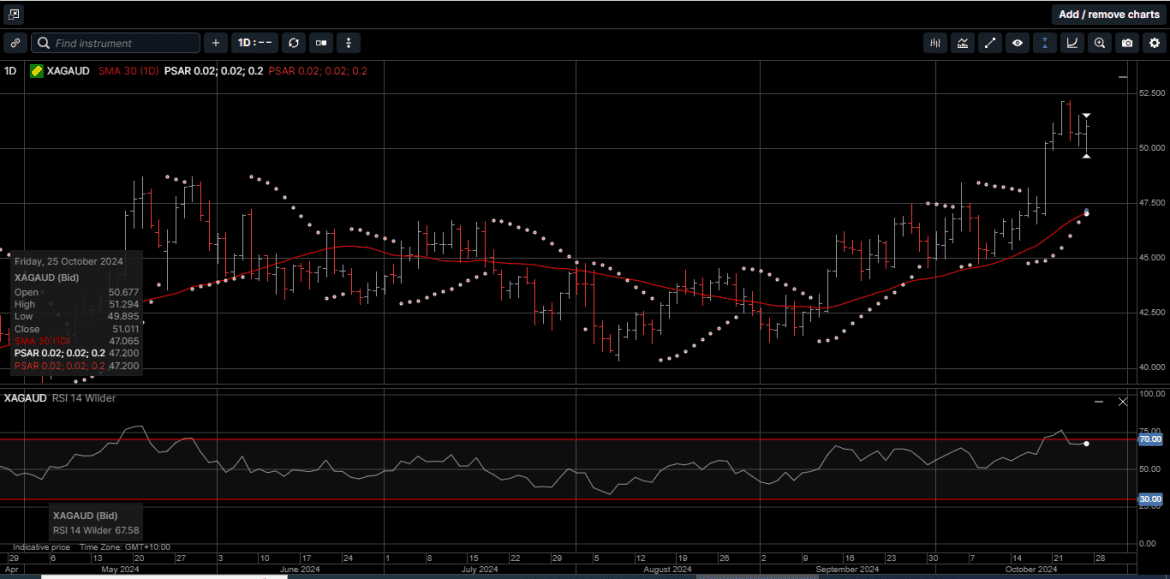

This was especially true for the precious metals complex last week.

Physical Gold priced in US Dollars has traded higher during six of the last seven weeks. In continuation of this trend, USD Gold posted a new all-time high of $2758.00 last Wednesday on the way to a 1.1% weekly gain.

The Gold price denominated in AUD has risen during 11 of the last 12 trading sessions and posted a new all-time high of $4160.00. AUD Gold traded in a wide 4.1% range last week on the way to a 2.5% weekly gain

After sliding to a three-month low of 78.75 in favor of Silver, the Gold vs Silver ratio bounced back to 81.40 as Silver prices underperformed Gold into the weekend.

For the week, USD Silver traded in a 3.5% range and finished unchanged at $30.70, while Silver priced in AUD reached a new all-time high of $52.15 and finished the week 1.5% higher.

With respect to the US Presidential election, the polls are tight and it’s difficult to predict who will win.

However, what is clear is that whoever takes the White House as the 47th President will have a plethora of fiscal and monetary challenges.

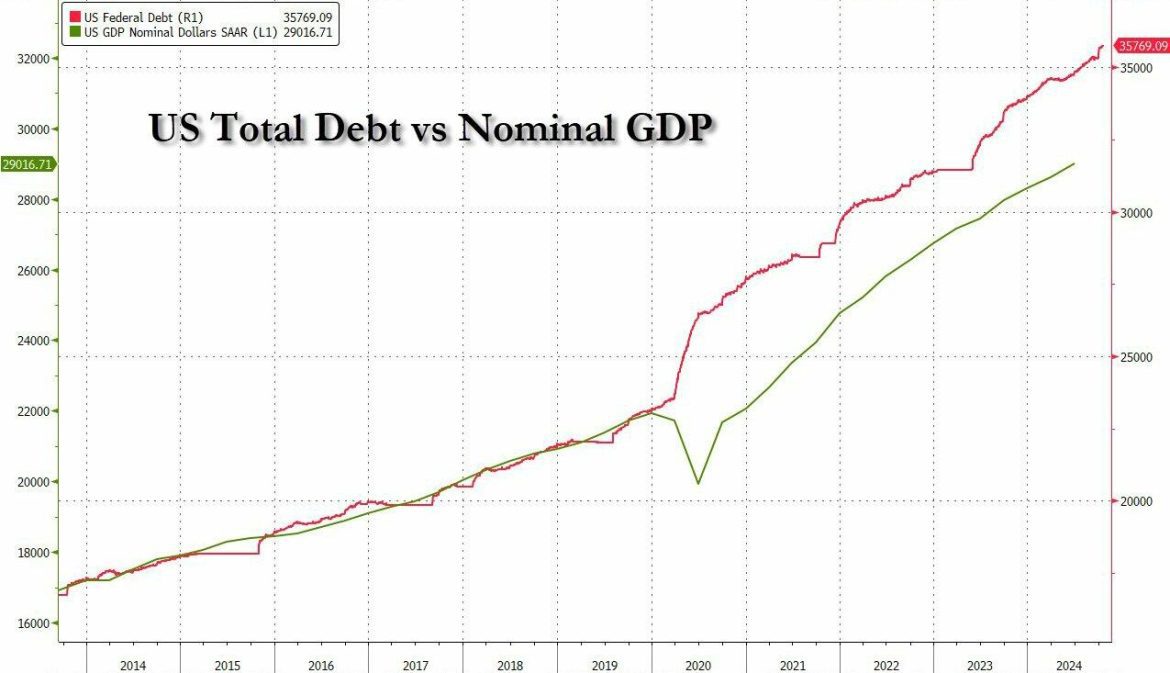

As illustrated on Chart 1, the US Debt to GDP ratio is now at 123% and rising steadily.

Recent reports on the tentative economic plans from each candidate estimate the US Debt will swell by $5 trillion if Mr. Trump wins and by $3.7 trillion if Ms. Harris wins.

The acknowledgement of these soaring deficits has raised questions about the reserve status of the US Dollar, which is bullish for Gold and Silver.

Another aspect of the potential decline of the USD reserve status is the rise of the BRICS group of nations.

BRICS is an acronym for Brazil, Russia, India, China and South Africa.

The 16th BRICS summit was held last week in Kazan, Russia.

Over the last 16 years the group of BRICS nations has expanded to 10 countries that all share the common goal of establishing an alternative trade and payment network outside of the US Dollar hegemony. This is known as De-Dollarization.

For roughly the last 75 years, the most formidable weapon in the US arsenal wasn’t fired from a barrel, launched from a ship or dropped from the sky.

But rather, in terms of projecting economic and strategic power globally, the most effective American weapon has been the US Dollar.

Since the formation of BRICS, the percentage of USD as a global reserve currency has slipped from 73% in 2010 to 63% in 2020 and now to 59% since 2022; when the US put sanctions on Russia for invading Ukraine.

The expanded BRICS group of nations now make up 45% of the world’s population, have a combined nominal GDP of $30 trillion, and represent 36% of global GDP.

With numbers like that, it would be reasonable to think that the US and other G-7 nations would be moving to mend the ideological gap with the BRICS group in an effort form a stronger economic framework.

Unfortunately, that thinking would be wrong.

Just two weeks ago the G-7 announced that they are looking to finalize a $50 billion loan to Ukraine that will be repaid using interest and profits earned on frozen Russian funds.

It seems clear that using Moscow’s money to pay for Ukraine’s war effort will be a major escalation in the economic war Washington and the EU is waging against Russia.

The scheme calls for giving Ukraine $50 billion, which will be dubbed a loan. However, rather than Kiev repaying the money, funds from frozen Russian assets in G7 nations will repay the loan.

More specifically, the loan for Ukraine is to be serviced from profits generated by Russian assets frozen in the US and Europe.

Of the estimated $320 billion of frozen Russian assets, more than two thirds of the assets, some 210 billion euros, are domiciled in the European Union. As such, the bulk of the money, or $35 billion, will come from members of the EU.

At this point, the US is withholding support over unease that a new US President could unfreeze the Russian funds, leaving no clear method for the loan to be repaid.

Incredibly, the EU is seeking to alleviate the White House’s concerns by voting to extend the freezing of the Russian funds by three years.

Using Russian money to fund the Ukrainian army’s operations against Russian soldiers will likely be viewed as a major provocation by Moscow, further destabilize the region, and increase the interest of developing nation to join BRICS.

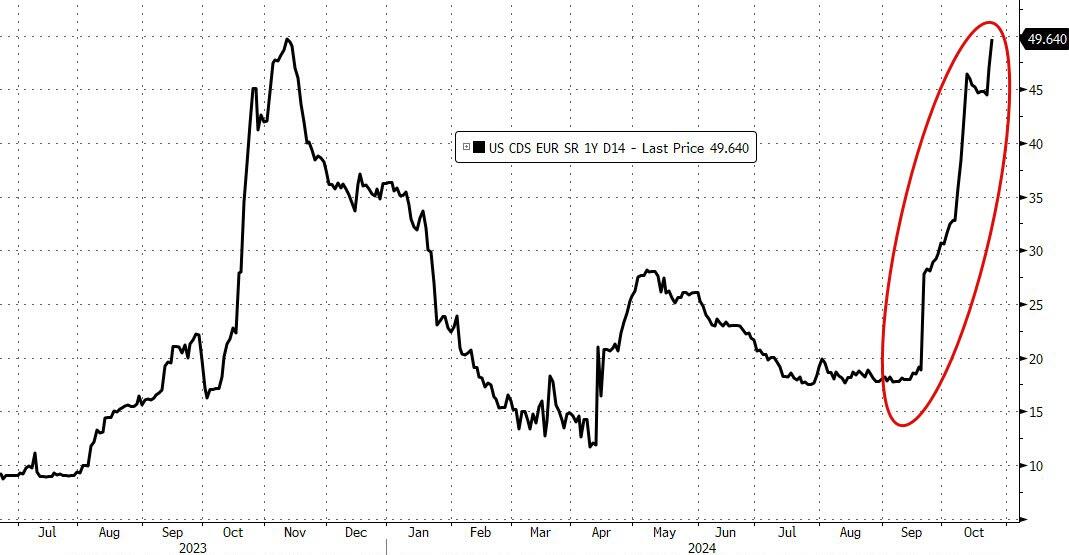

With the level of political and economic uncertainty rising each week, it’s not surprising that the risk of a US credit default is also rising.

As shown on Chart 2, the cost of US Credit Default Swaps has more than doubled since the FED lowered interest rates on September 17th.

In summary, the US will soon elect a new President who will inherit a $36 trillion debt which is growing by a trillion dollars every 100 days, the BRICS group of nations is expanding and making progress with their de-Dollarization business network, the G-7 is planning more aggression toward Russia by using their own sovereign assets to fund Ukraine’s war effort against them, and the price to insure US government debt from default has doubled in just over a month.

With all of this uncertainty in the world, it should be no surprise that Gold and Silver have been two of the best performing assets over the last 12 months.

Gold and Silver have a time proven track record of success and security during uncertain economic times.

As such, investors should consider physical Gold and Silver as the cornerstone assets in their long-term wealth building strategy.

Chart 1 US Debt to GDP

Chat 2 US credit default swaps

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.