Gold Cracks $2700, Silver Posts a 12-Year High

Gold Cracks $2700, Silver Posts a 12-Year High

The European Central Bank (ECB) cut their overnight reference rate by 25 basis points to 3.40% last week and, according to ECB chief Christine Lagarde, they have intentions to ease further into 2025.

This policy action and guidance from the ECB underpinned the global easing narrative and gave a boost to the precious metals complex.

Physical Gold priced in US Dollars traded higher every day last week and reached a new all-time high of $2722.00 for a 2.4% gain for the week.

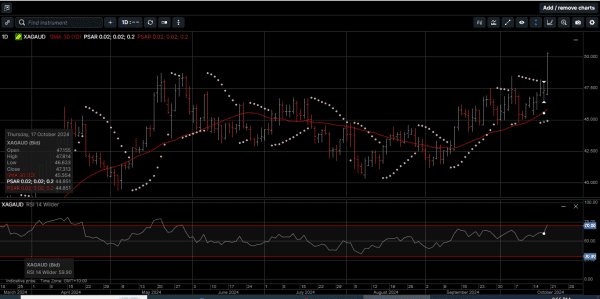

Gold denominated in AUD was also well bid and posted a new all-time high of $4060.00 and finished the week 3.1% higher at $4055.00.

Silver prices outpaced Gold by a large margin last week with USD Silver up 7.0% to a 12-year high of $33.75 and AUD-based Silver surging by 7.6% to mark a new all-time high of $50.33.

Along those lines, the Gold versus Silver ratio moved to a three-month low in favor of Silver at 80.50.

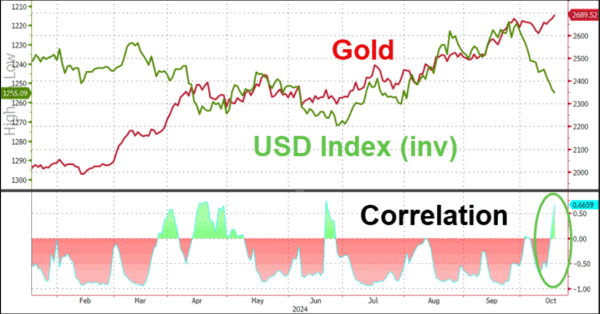

Interestingly, as illustrated on Chart 1, even though the US Dollar Index has firmed over the last two weeks, Gold and Silver prices have still traded higher.

A big reason for this is that the market is finally starting to sweat the outcome of the US presidential election on November 5th, which until very recently, it would blissfully pretend doesn’t matter.

The steady rise in Gold and Silver prices this year is now being compared to the great bull market of the late 1970s.

Gold is on pace to have its biggest gains since 1979. And it’s not a coincidence that both Gold and Silver are moving higher just as the US FED is at the beginning of an easing cycle and cutting rates.

In July of 1973, the FED Funds rate was 4.50%. By October of 1980, the rate had risen to 12.80%.

This means the FED was tightening interest rates the entire time that Gold and Silver were rallying from 1973 to 1980.

In fact, As shown on Chart 2, it was only after the FED got the FED Funds rate to 13.00% that the protracted bull rally in Gold and Silver ended.

In contrast, it’s reasonable to believe that the current bull market in Gold and Silver is just getting started, because the FED is nowhere near preparing to raise rates.

Further, with only 0.5% of global financial assets invested in Gold today, any significant increase in demand cannot be satisfied by physical Gold, at anywhere near current prices.

Mines around the world produce around 3,000 tons of Gold annually. That amount of Gold is pretty much absorbed every year, and there are very limited surplus stocks of metal.

In fact, there have been reports of significant shortages of physical Gold.

As global economic dynamics continue to shift, Gold and Silver are likely to remain in focus for long-term investors looking to diversify their portfolios against economic uncertainties.

The current market conditions provide a compelling opportunity for hard asset investors to add to their physical Gold and Silver holdings.

At this point in the economic cycle, Gold and Silver can be considered the everything hedge, since they are the purest forms of money and can protect your wealth against geopolitical risk, stock market risk, currency risks and inflation.

Chart 1 Gold Vs USD:

Chart 2 1970s Gold rally:

Chart 3 Gold AUD:

Chart 4 Silver AUD:

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.