Gold Breaks Through $2600.00 After the FED Lowers Rates

Gold Breaks Through $2600.00 After the FED Lowers Rates

The month-long rally in the precious metals complex accelerated last week after the US FED’s decision to commence their easing cycle with a 50-basis point rate cut.

The FED’s adjustment to the benchmark interest rate brought an end to the 13-month plateau between the last rate hike and first cut.

Physical Gold and Silver both traded higher after the FED’s monetary policy decision on the prospects of additional easing into the end of the year.

Gold in USD posted its ninth new all-time high of the year at $2625.00 and a gain of 1.7% for the week.

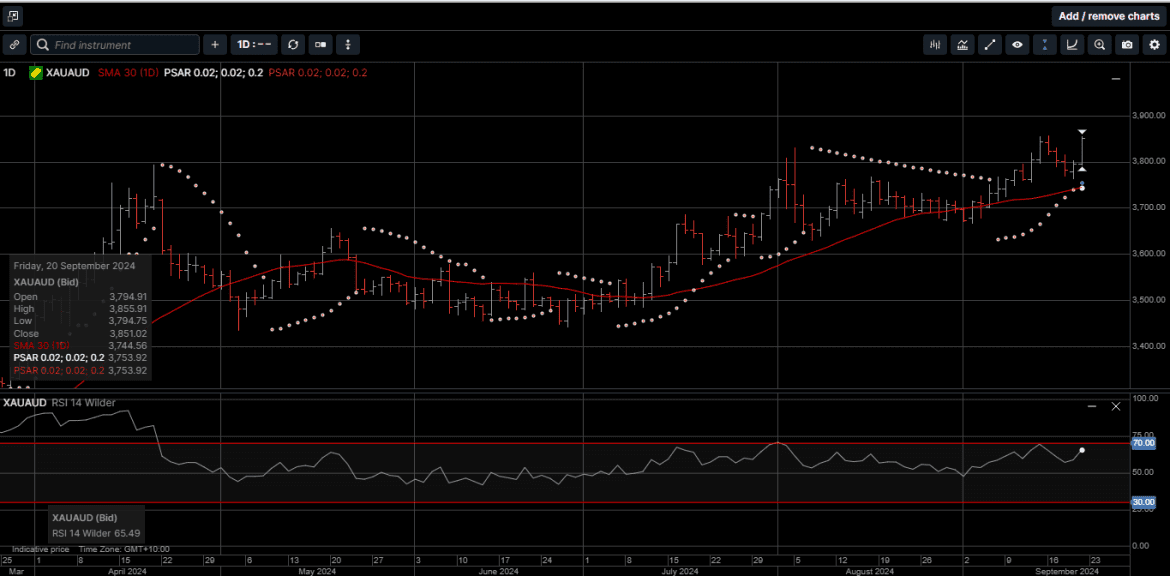

Gold dominated in AUD came within a whisker of a new all-time high and finished the week fractionally higher at $3851.00

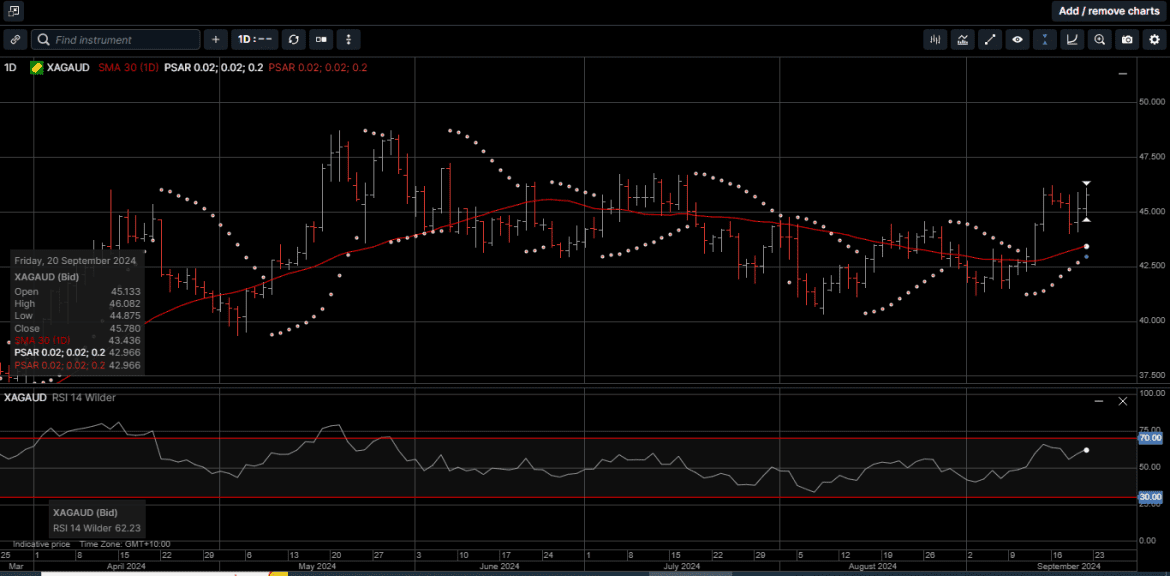

USD Silver continues to build upside momentum and reached a two-month high of $31.40 on the way to a 1.4% gain for the week, while AUD Silver was dampened by the AUD/USD strength and closed unchanged.

Last week’s rate cut was widely telegraphed by the Fed’s communications, in the FOMC minutes of the last meeting, and by Fed governors in their speeches after the recent flurry of lower than expect employment reports.

However, the size of the cut was not telegraphed and was not the consensus of the financial community.

In fact, the size of the cut was not even the consensus within the voting members of the FED itself.

Michelle Bowman, governor of the Kansas City FED, dissented and voted for a 25-basis-point cut.

Ms. Bowman became the first FED governor to vote against an interest rate decision by the US central bank since 2005, denying FED Chief Jerome Powell a clear policy consensus at a pivotal time.

This announcement comes after the CPI inflation report a week ago showed that core CPI re-accelerated in August from July, the second month in a row of month-to-month acceleration.

But as Mr. Powell suggested in his Jackson Hole speech on August 24th, the Fed is going to “look through” a re-acceleration of CPI inflation and focus on the US labour market.

Last week’s 50-basis point cut brought the mid-point of the Fed’s target range to 4.875%.

For the end of 2024, the median projection for the Federal Funds rate is now 4.375%, so an additional 50 basis points in cuts in 2024, which based on the FED’s projections, is now favoured by 9 of the 12 voting FED governors.

With Wall Street stocks near all-time highs and Consumer inflation trending higher, some analysts questioned the “panic-style” 50 basis point rate cut.

Maybe the FED is just tired of losing money on their crummy bond holdings?

Since September 2022, the FED has consistently booked operating losses, as the interest it pays money market funds and other counterparties have outpaced the interest income from its shrinking portfolio of Treasury securities that it purchased when yields were much lower than now.

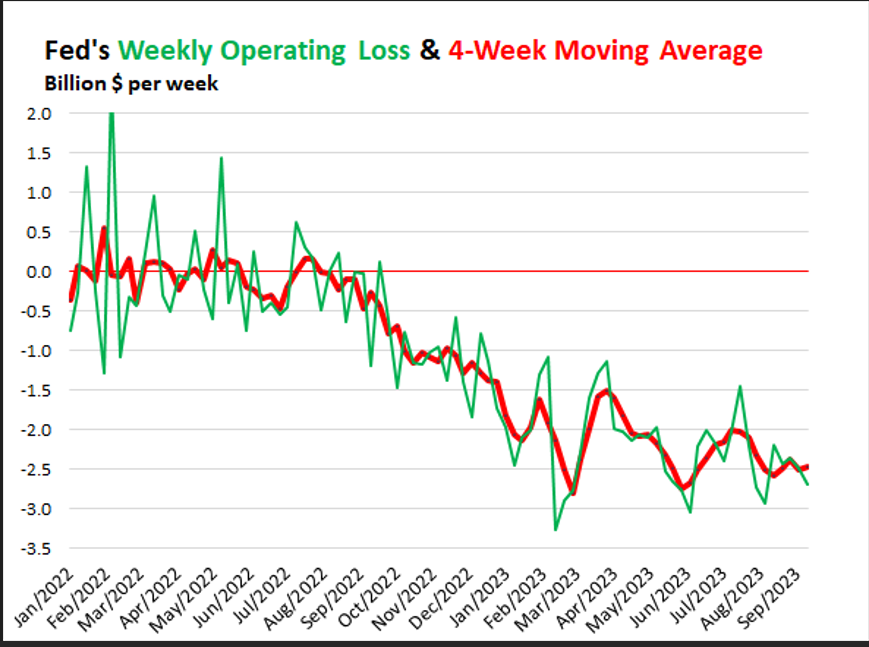

As illustrated on Chart 1, the weekly losses (green) and the four-week moving average of the weekly losses (red).

In August and September so far, the weekly losses have averaged a little under $2.5 billion per week.

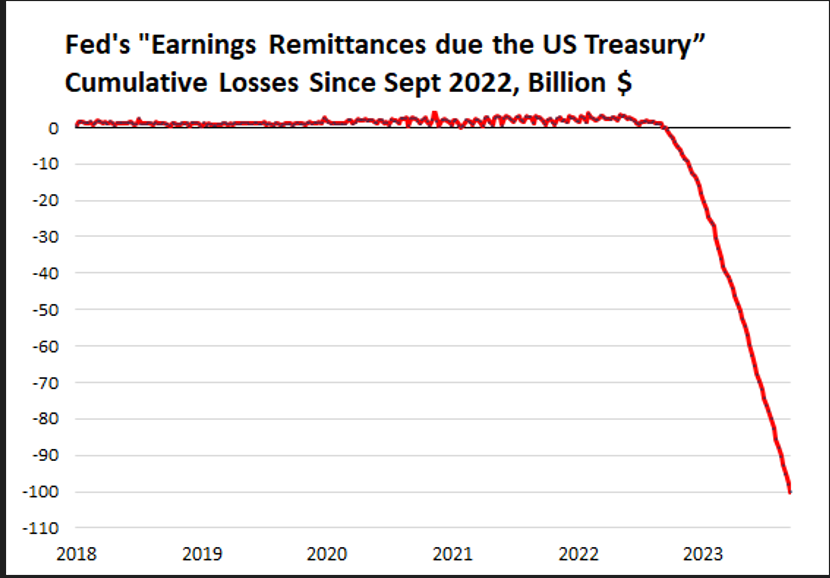

And while $2.5 billion per week may sound like a rounding error to the US FED, the cumulative impact is difficult to sweep under the financial rug.

As shown on Chart 2, this liability account, “Earnings Remittances due to Treasury,” where the Fed tracks its operating losses, has a negative value of $100 billion since 2018, which is a great deal of red ink on any central bank’s balance sheet.

The USA is $35 trillion in debt, or about 125% of GDP, with a weak, highly dysfunctional government that embraces imprudent spending and cannot compromise on the most basic priorities.

And yet the 10-year yield is less than 4%.

But after last week’s policy pivot, the FED says even 4% is too high, therefore interest rates must fall.

And they’re right. Think about it: the national debt is expanding at an exponential pace, and it will likely pass $50 trillion within the next 5-7 years

If interest rates average 4%, that means the government will spend over $2 trillion each year just to pay interest.

The FED knows this is totally unsustainable. They know the only way that the US government can function anymore is if interest rates are essentially 0%.

And that’s why they cut rates by 50 basis points last week: because the US government can’t afford to pay 5.25% on overnight Fed Fund deposits.

The FED governors talk about the resilience of US economy and manageable inflation rate, but these are just excuses to justify the magnitude of the rate cut.

Ultimately this combination of low interest rates and extreme deficits will create a lot more inflation.

But the FED had fallen behind the curve and had to choose between the two bad results of higher inflation versus a bankrupt US government.

And the FED, almost unanimously, chose higher long-term inflation.

That’s why it makes so much sense now to make physical Gold and Silver the cornerstone assets within a diversified portfolio for wealth creation.

Just look at the numbers, at the close of business last week, USD Gold has gained 30% for the year, AUD gold is up 26.7%, USD Silver has returned 31% and AUD Silver is up 33.2% since January.

Chart 1 weekly FED losses:

Chart 2 Longer term losses:

Chart 3 Gold AUD:

Chart 4 Silver AUD:

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.