Gold and Silver: The Four Pillars of Support

Gold and Silver: The Four Pillars of Support

After trading in a relatively narrow range near all-time highs, USD-based Gold finished last week fractionally lower but above initial support levels in the $2630/40 area.

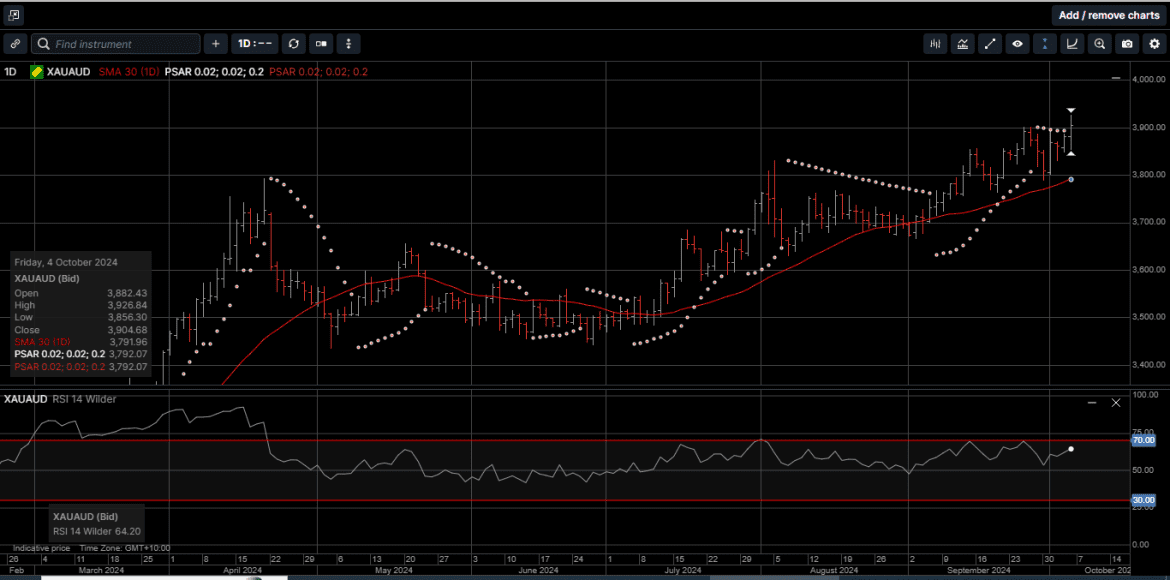

Australian Dollar denominated Gold posted a new all-time high at $3926.00 and the first weekly close above $3900.00, on the way to a 1.4% gain for the week.

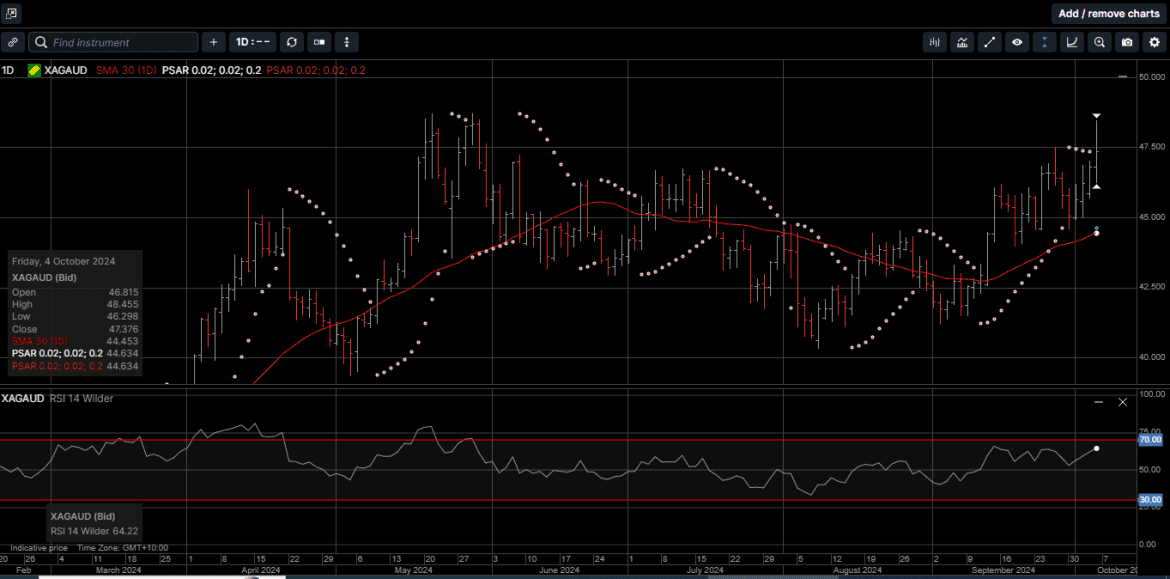

USD Silver reached a four-month high just under $33.00 and weekly gain of 1.8%, while AUD-based Silver posted a 3.4% gain for the week and looks poised to break above the all-time high of $48.75.

Silver has now outperformed Gold during five of the last six weeks, which has pushed the Gold vs Silver ratio down by almost 10.00% to 81.00 since early September.

There were several developments last week that shaped the global investment climate.

First, the September US employment report was stronger than expected, which prompted questions about the timing of the recent FED interest rate adjustment.

After initiating their easing cycle with a 50-basis point cut, the central bank is not in a rush to ease aggressively and two 25 basis point cuts going into the end of the year is the most likely scenario.

Second, the Eurozone’s preliminary September Consumer Price Index (CPI) fell below 2%. This boosts the chances of a European Central Bank rate cut when it meets again on October 17th.

Third, Bank of England Governor Andrew Bailey hinted at an acceleration of BOE interest rate cuts.

As a result, the British Pound dropped by 2.6% versus the USD even though the swaps market assessment of a 60% chance that the BOE lowers rates by 50 basis points in Q4 was unchanged on the week.

The US September CPI on October 10th is the most important high-frequency economic data point in the week ahead. A core CPI print above 2.6% could trigger market sentiment that the US FED has created a policy error by cutting rate too early.

Looking at a broader timeframe, Gold and Silver prices have been pushing relentlessly upward, shattering records and defying expectations over the last 10 months.

Gold is now experiencing its strongest rally in over 40 years and Silver is on course to have its best year since 2008.

Several factors are contributing to this influx of investor interest, which we’ve designated the Four Pillars of Hard Asset Support.

Geopolitical Tensions: The ongoing Russian-Ukrainian conflict and rising tensions in the Middle East have heightened global uncertainties, driving investors towards safe-haven assets like Gold and Silver.

Interest Rate Cuts: The U.S. Federal Reserve’s aggressive interest rate cut and expectations of further easing from the US and Europe have made Gold and Silver more attractive by reducing the opportunity cost of holding it.

Weakening US Dollar: The USD’s 6.3% decline since early April has made Gold and Silver cheaper for holders of other currencies, further stimulating demand.

Economic Uncertainties: Lingering concerns about global economic growth, soaring deficits and inflation have also boosted the appeal for Gold and Silver as a hedge against economic instability.

The long-term outlook for hard assets remains positive, with several factors likely to sustain the upward trajectory of prices.

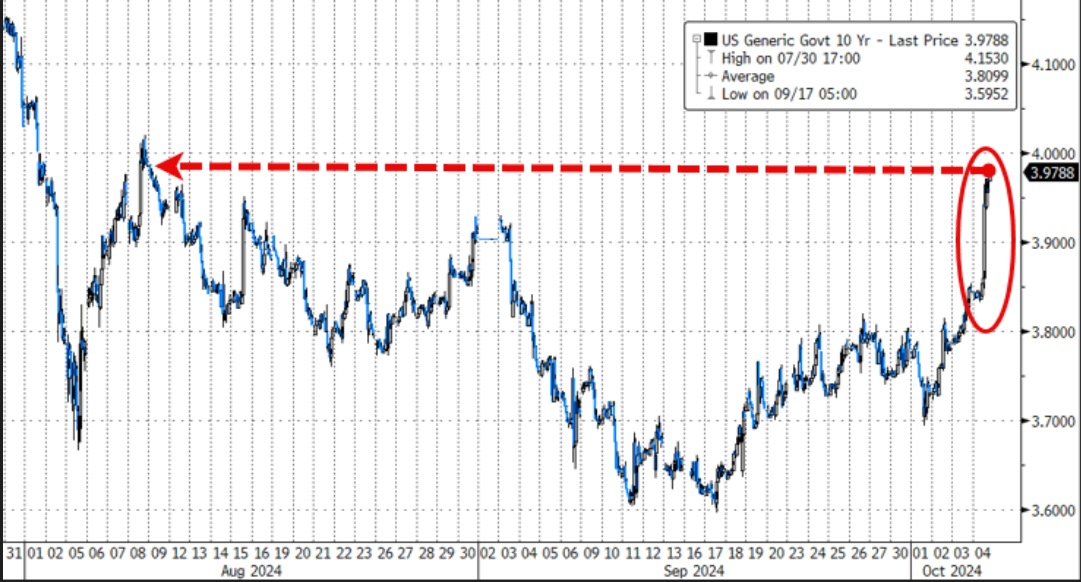

Moreover, as illustrated on Chart 1, since the FED’s 50 basis point cut on September 18th, US 10-year bond yields have risen by 32 basis points, or 8.7%.

More concerningly, as shown on Chart 2, the risk premium of US Credit Default Swaps has become 80% more expensive over the same period of time with a 10% increase last week.

It looks like something is not right under the hood of the US credit markets and banking system.

As such, the ongoing investor interest in Gold and Silver is a testament to the enduring appeal of these precious metals.

Gold and Silver’s unique combination of safety, liquidity and monetary value makes them an attractive investment option in times of economic uncertainty.

As the global economy navigates a complex and uncertain landscape, Gold and Silver’s role as a safe-haven asset and a store of value is likely to become even more prominent for investors looking for a long-term wealth creation strategy.

Chart 1 US 10 year yield

Chart 2 US Credit Default Swaps

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.