Tariff Terror Pushes Gold and Silver Lower

Over the last four weeks, market commentators speculated about how US trade tariffs would impact global capital markets.

Last Wednesday, the US administration announced that reciprocal tariffs of 10% or more would be added to imports of goods from over 90 countries.

This plan represents a much broader than expected spectrum of tariff targets.

As such, the market response was severe and widespread as volatility spikes and record trading volumes were seen across several asset classes.

Physical Gold priced in USD posted a new record high of $3167.00 before reversing more than $120.00 lower to close down 1.5% at $3036.00.

Gold denominated in AUD also reached a new all-time high of $5167.00 but fell into the end of the week to close at $4996.00. However, the 4% drop in the AUD/USD limited the downside allowing for a weekly gain of 1.9%

Physical Silver prices fell hard as the market perceived that the tariffs could cause an economic recession, which would sharply reduce industrial demand for the white metal.

Silver priced in USD lost 13.2% and closed near a three-month low of $29.57.

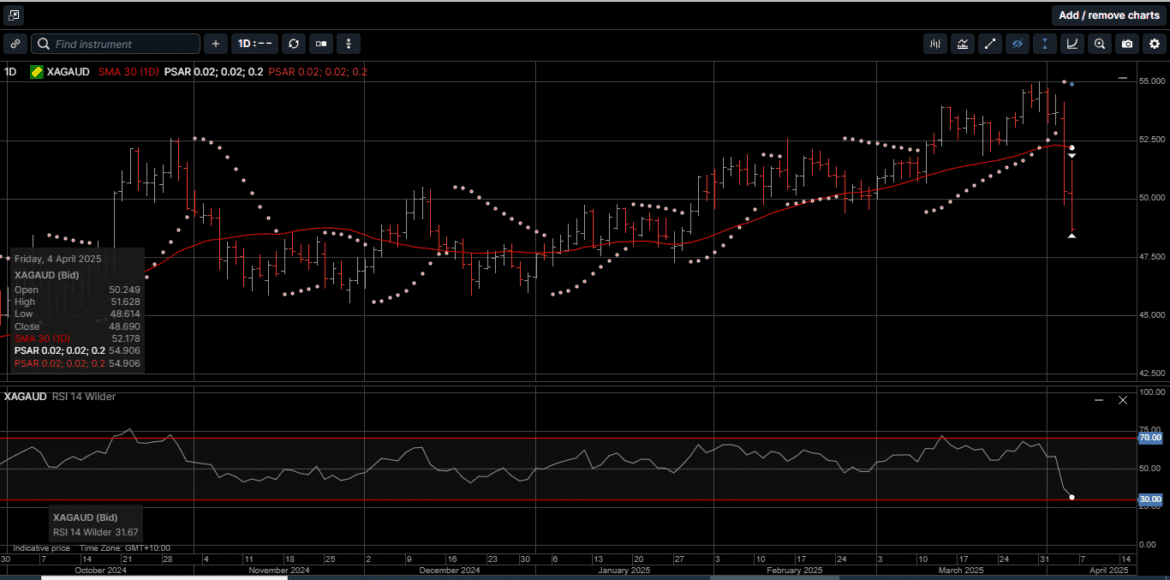

AUD based Silver tagged a new all-time high at $55.01 before slipping lower to close out the week with a 10.2% loss at $48.70. Like AUD based Gold, the sharp fall in the AUD/USD limited the downside pressure.

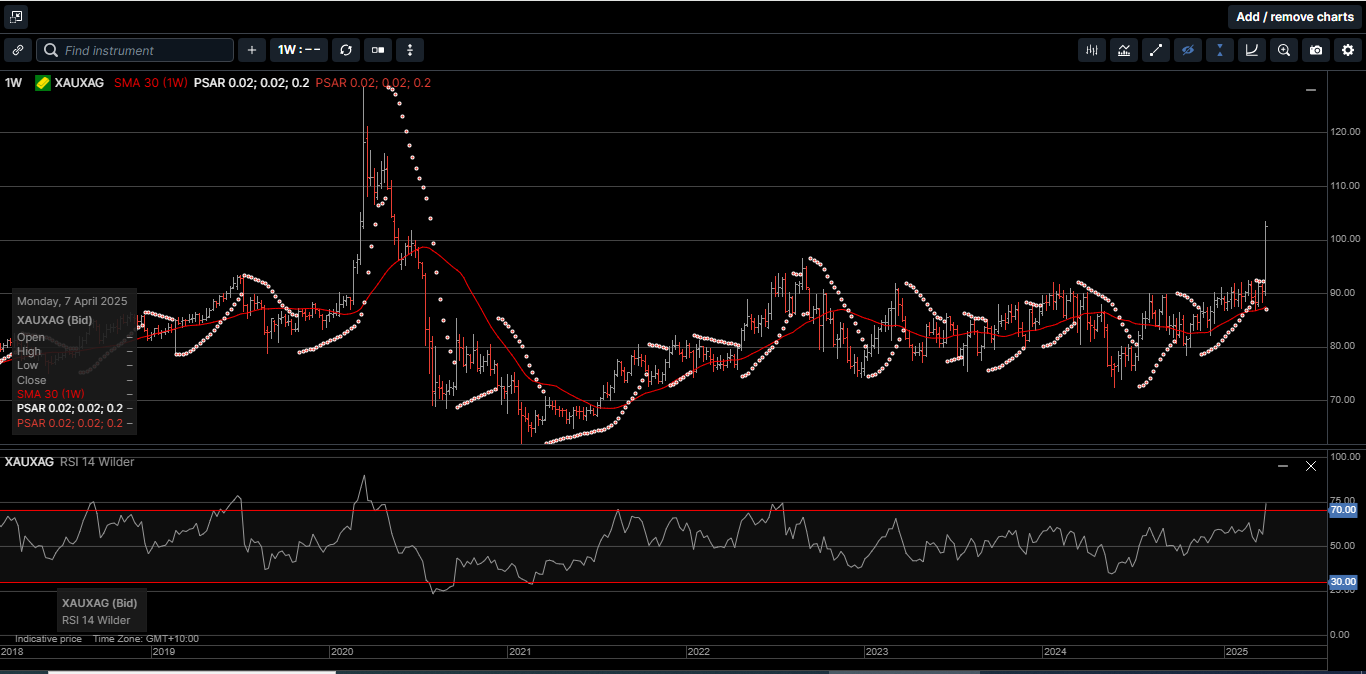

The Gold versus Silver ratio had its most volatile week since the outbreak of COVID back in March of 2020.

As illustrated on Chart 1, the ratio spiked as high 103.45 and settled at 102.50 compared to 91.00 at the beginning of the week. That means it now takes 102.50 ounces of Silver to equal the price of one ounce of Gold.

From a technical perspective, this ratio could unwind back into the recent ranges if the tariffs announced last week are somehow adjusted or paused, in which case the industrial bid for Silver could return.

This is especially true if the market perception is that tariffs will be negative for equity assets and more positive for safe haven hard assets.

Global equities got hammered last week as markets understood what tariffs actually are: A tax on corporate profit margins that companies will have a very hard time passing on to customers.

If they could pass them on easily, they wouldn’t care about tariffs; their revenues would go up by the amount of the tariffs, and their profit margins in percentage terms could be maintained, and their stocks would keep rising. But that’s not the case.

The S&P 500 fell 9.1% last week, the Dow Jones 30 slipped 7.8% and the NASDAQ lost 9.7%.

Most of these losses were during Friday’s trading session, which saw the highest single day trading volume in the history of Wall Street.

Still, these indexes are up over the last two years by 23%, 21% and 38%, respectively. Which means there is a great deal of potential downside repricing.

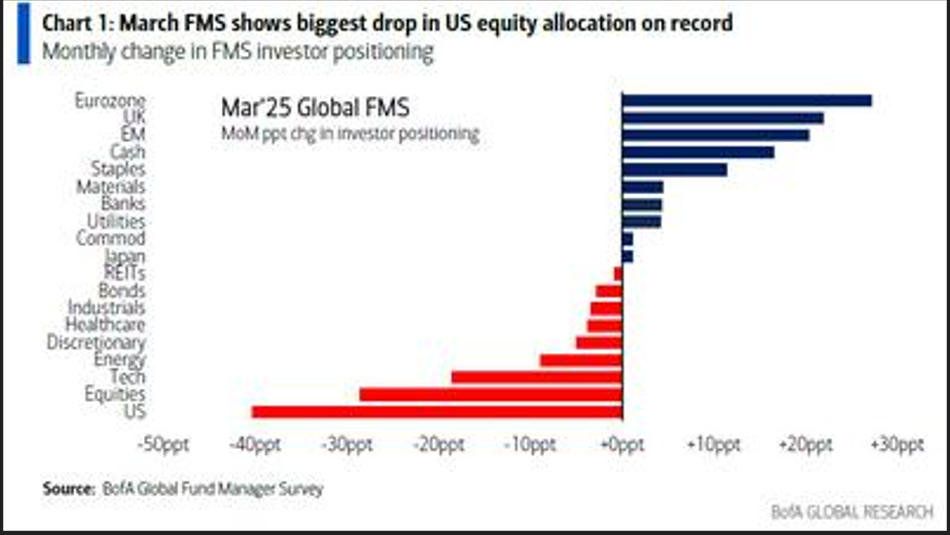

In fact, as shown on Chart 2, even before last week’s equity market selloff, Institutional equity allocations were moving out of the US sectors and into assets with less lofty valuations.

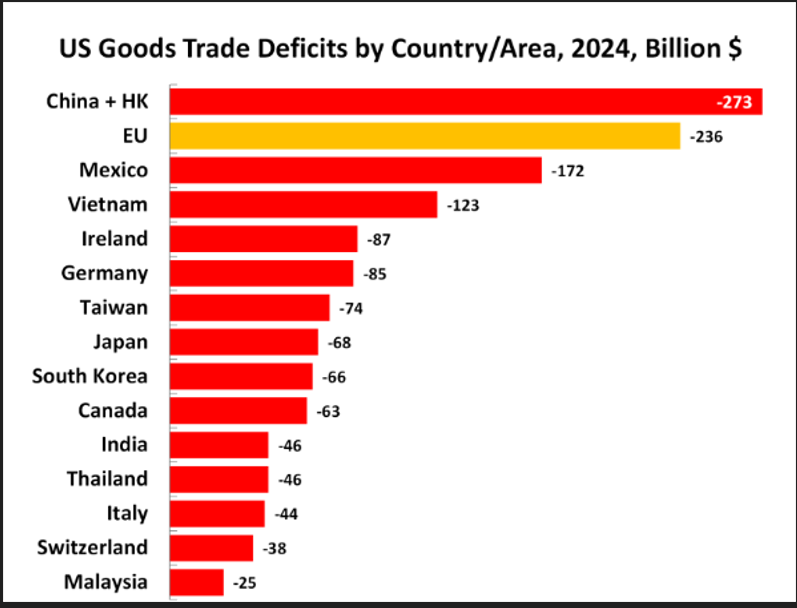

And while the news that US tariffs were going to be imposed on imports from over 90 countries rattled global markets, the largest financial stakes can be scaled down to a handful of trading partners.

As shown on Chart 3, the top 10 deficit nations make up over 75% of the aggregate $1.4 trillion annual trade deficits with the US.

This suggests that the tariff panic that gripped financial markets last week could subside in a matter of days and weeks, as opposed to months or years.

Along those lines, we would expect to see investors with a longer-term time horizon continue to rotate out of riskier paper assets and into the time proven security of Gold and Silver.

None of the fundamental reasons for holding physical Gold and Silver as a cornerstone asset within a personal wealth creation strategy were changed last week.

Developed economies are still swamped with debt, systemic banking risks from deteriorating commercial real estate valuations are still growing and geopolitical conflicts are still simmering.

In short, last week’s correction lower in Gold and Silver is a dramatic call to action for investors of all levels of sophistication to add more hard assets to their portfolio before the next leg higher.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.