Physical Gold Cracks $3000.00

The precious metals complex posted another strong week as global equities and the USD extended their month-long slide.

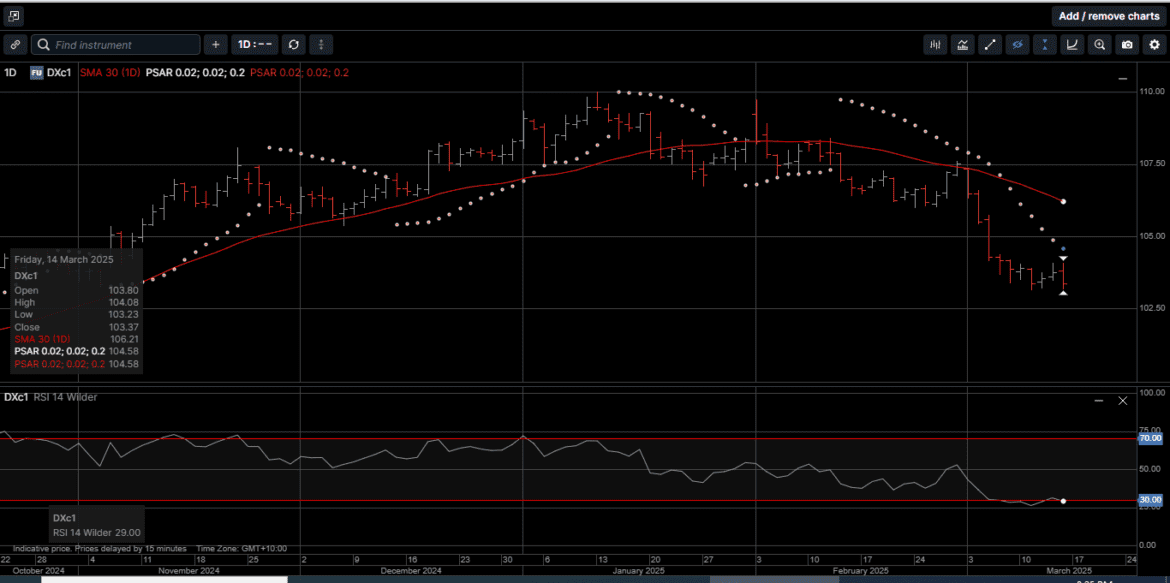

As illustrated on charts 1 and 2, concerns over the economic impact of increased tariffs have pressured the USD Index and the S&P 500 more that 10% lower over the last four weeks.

The USD weakness combined with falling stocks and rising geopolitical tensions has been a positive driver for physical Gold and Silver prices.

Gold priced in US Dollars raced to a new all-time high of $3004.50 during last Friday’s London session before drifting lower into the weekend to close 2.6% higher at $2984.00.

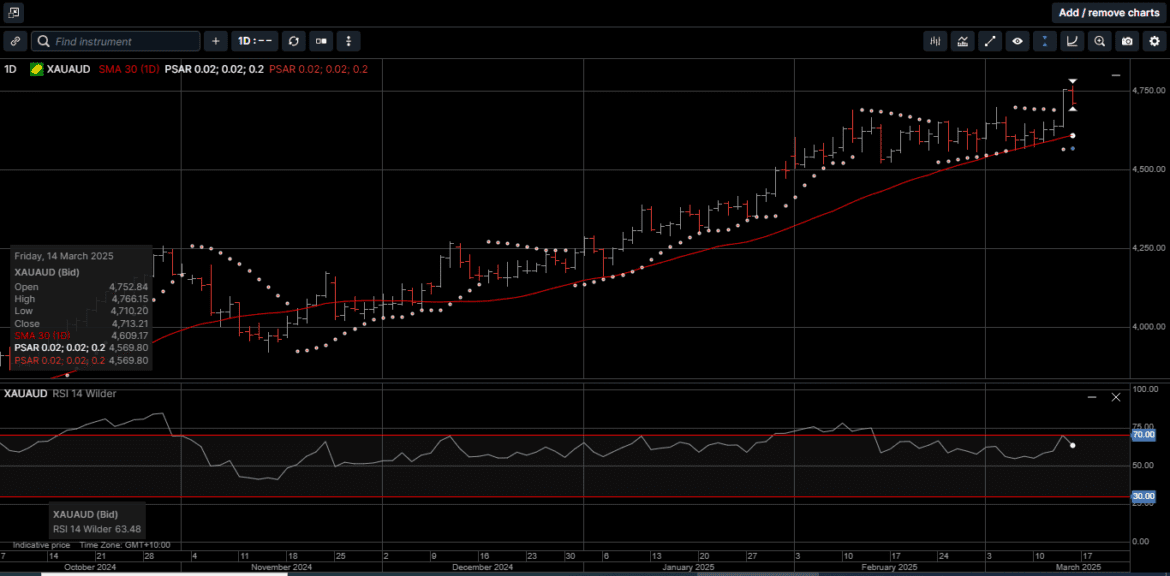

Gold denominated in AUD also posted a new all-time high of $4755 and settled the week 2.2% higher at $4715.00.

Interestingly, internal momentum indicators are not reflecting overbought conditions for Gold in either currency, which suggests potentially higher prices before entering a short-term technical consolidation phase.

Physical Silver prices outperformed Gold for the third consecutive week.

USD based Silver tagged a five-month high of $34.10 and closed the week 3.9% higher at $33.77.

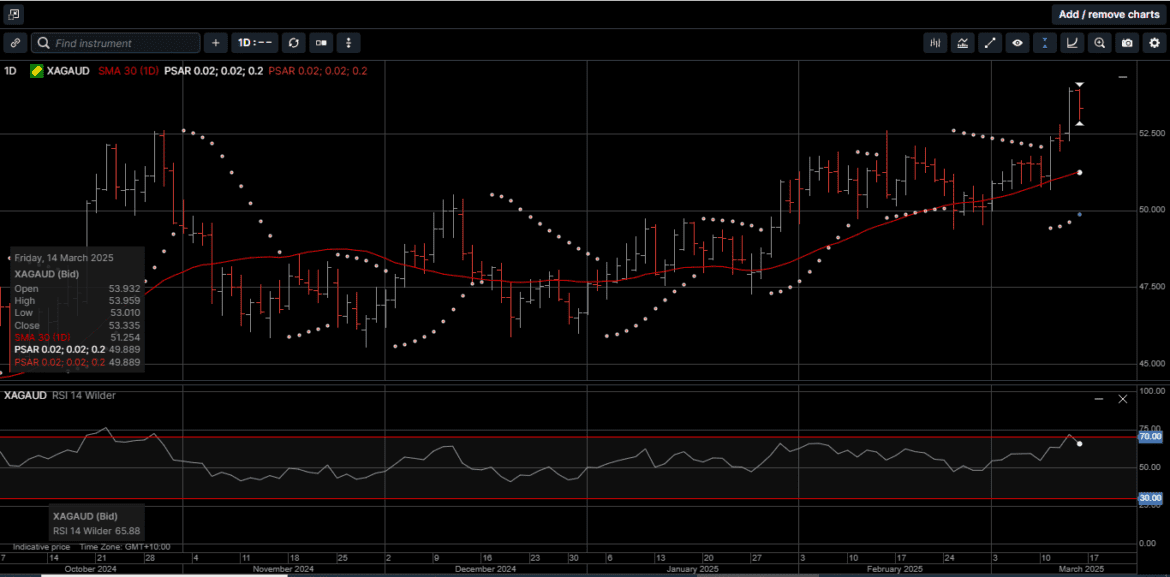

Silver priced in AUD hit a new all-time high at $54.00 on Thursday before pulling back on Friday to finish the week 4.8% higher at $53.45.

As shown on Chart 3, the Gold versus Silver ratio reached a three-month low of 87.00, which means since March 4th, the price of physical Silver has outperformed physical Gold by almost 6.00%.

In the wake of the Trump administration’s recent tariff policies, it seems the global financial landscape has been thrown into turbulence.

Investors and consumers alike are feeling the pinch as the stock markets spin lower and global recession fears loom.

However, amidst all this economic uncertainty, one asset class has emerged as a benchmark of stability: precious metals, specifically Gold and Silver

What has allowed Gold and Silver to weather and even excel in this volatile economic environment?

The primary reason is that the value of Gold and Silver are not dependent on any counterparty asset including the US Dollar.

Unlike fiat currencies, Gold and Silver have intrinsic value because of their various applications in manufacturing, technology, and medical devices.

As such, while the tariff-induced inflation has stunted dollar-dependent companies, Gold and Silver remain relatively resistant because of their lack of dependency on the political climate.

In fact, the more volatile the economic climate is, the more valuable stable hard assets like Gold and Silver become.

As the uncertainty increases surrounding the US tariff policies, the economic landscape reveals a stark contrast between traditional investments and the enduring value of precious metals.

While stocks tumble and recession fears grow, Gold and Silver stand as a testament to the importance of diversification and the enduring appeal of tangible, hard assets.

For investors of all levels of experience seeking stability, precious metals offer a compelling alternative to the volatility of the stock market.

During these uncertain times, the wisdom of including physical Gold and Silver in one’s portfolio has never been more apparent, providing a potential safe haven from tariff-induced market fluctuations.

Now is the time to consider adding more physical Gold and Silver to your long-term wealth creation strategy.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.