Gold, Silver and Tariffs

The Gold and Silver markets have well and truly awakened from their holiday slumber as last week’s price action saw wide intraday ranges driven by heavy trade flow.

Physical Gold priced in USD traded above the 30-day moving average every day last week, posted a one-month high at $2728.00, and closed 1.4% higher at $2701.

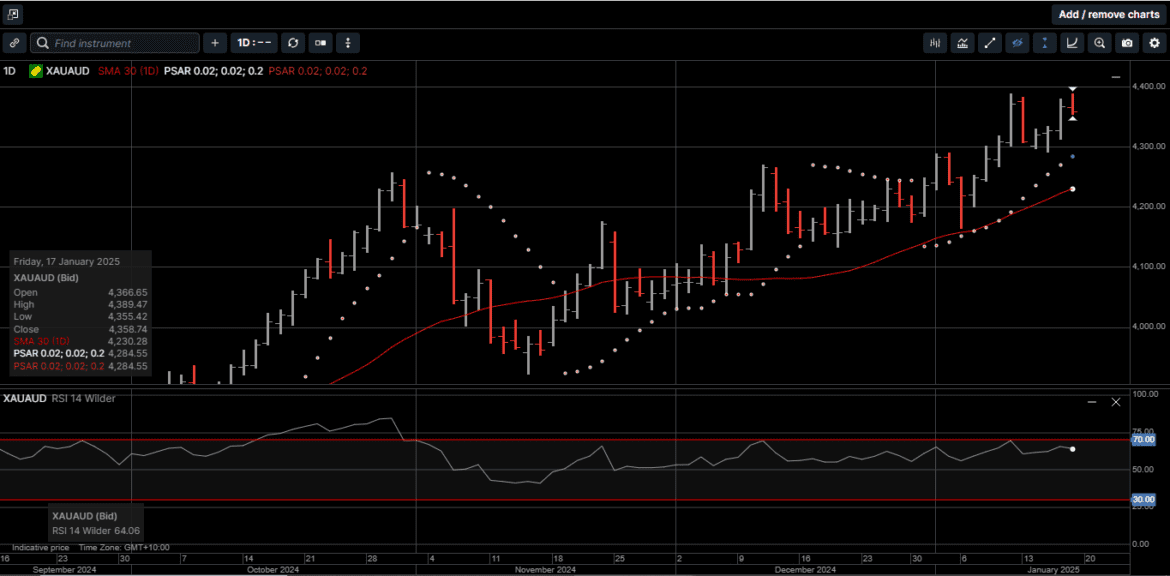

Gold denominated in AUD reached a new all-time high of $4389.00 but slipped lower into the weekend to close fractionally lower at $4358.00.

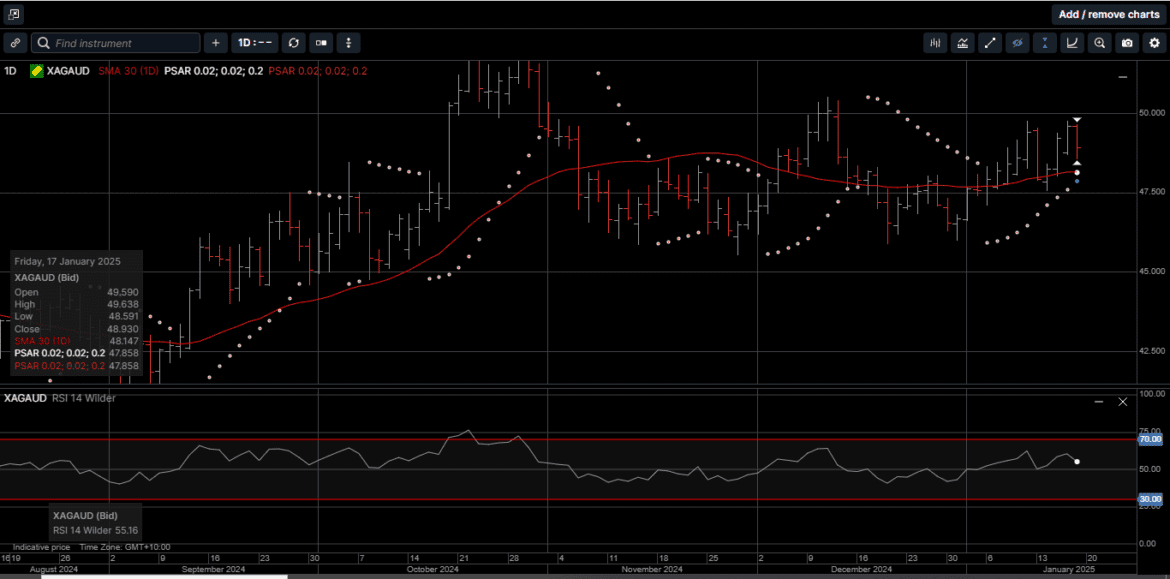

After seeing sharp mid-week gains, physical Silver priced in both USD and AUD reversed lower to finish the week unchanged at $30.33 and $48.93, respectively.

As such, the Gold vs Silver ratio closed fractionally higher at 88.60 after testing resistance just above the 90.00 level.

We believe that one of the reasons Silver prices have been more volatile than Gold over the last several weeks relates to the potential tariffs discussed by the incoming Trump administration.

In addition to being a safe haven asset, Silver is also generally considered an industrial metal which could be impacted by tariff induced trade disruptions.

In the immediate aftermath of the US election, we reviewed developed markets for signs that tariffs were getting priced into a broad range of assets.

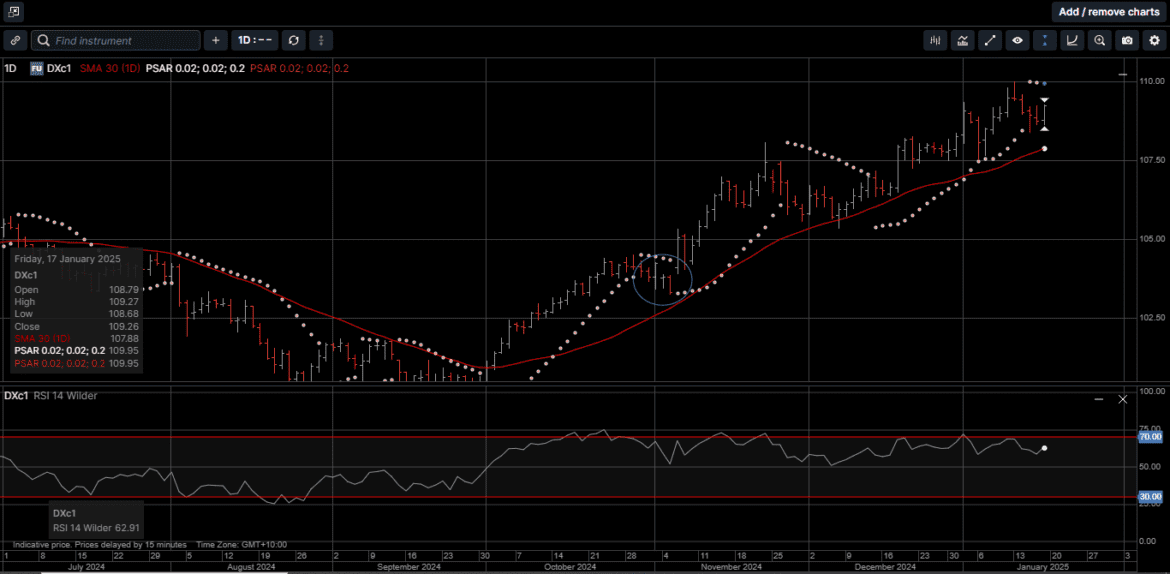

As illustrated on Chart 1, since the election on November 5th, the US Dollar has risen by almost 6%.

However, that rise in the USD looks like it was driven by expectations of faster US growth, not by markets putting meaningful probability on additional tariffs.

This picture has grown even more pronounced since the start of the year, with the USD rising further, but not versus currencies that would be most impacted by tariffs, such as the Chinese Yuan or Japanese Yen.

We believe that the tariff confrontation between the US and China poses the most significant market risk.

China’s most potent weapon is a protracted depreciation of the Yuan as an offset to additional US tariffs.

Such a depreciation could weigh on Wall Street stock indexes, causing repercussions to the US in the form of tighter financial conditions, which could be why US 10-year bond yields have moved 9.5% higher since the election.

The incoming administration may try to pre-empt this via sector-specific tariffs or, if it goes the path of a universal tariff, by phasing in such a tariff and making it conditional on certain benchmarks China must meet.

Either way, given how little tariff risk is currently priced, it seems likely that market volatility will broadly rise in the months ahead.

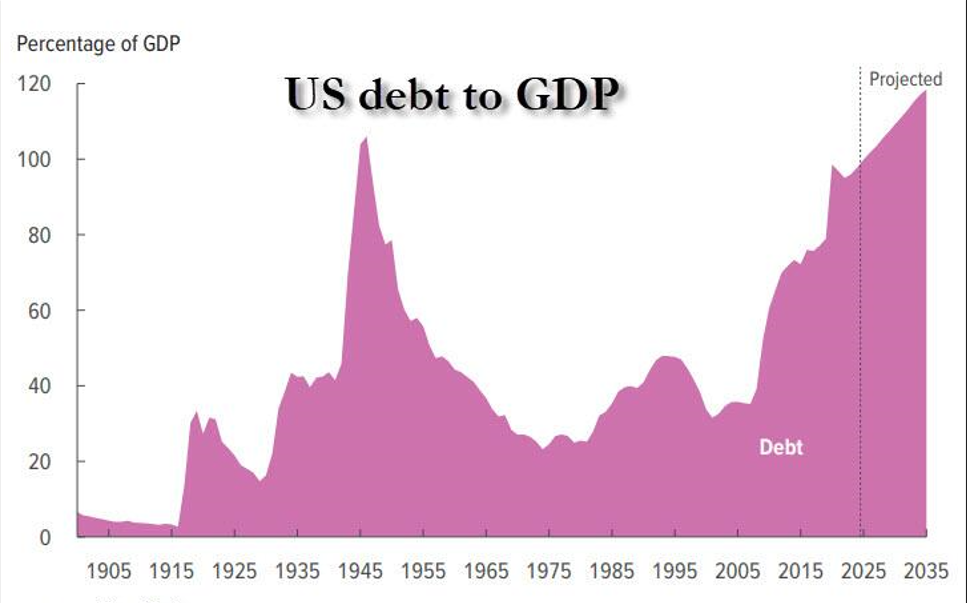

Further, as shown on Chart 2, the incoming administration is facing a deteriorating debt to GDP imbalance which will only get worse if financial conditions in the US tighten.

So, even though the USD Index has been rising along with US interest rates over the two months, since the beginning of 2025, USD Gold is up 3.0%, AUD Gold is up 2.8%. USD Silver has risen by 5.0% and AUD Silver has risen by 4.6%.

In other words, if investors are pushing Gold and Silver prices higher in a strong USD and higher rate environment, the potential for a longer-term rally as the market prices in a lower USD looks very attractive.

We believe that true wealth is not just about the money you accumulate, but the financial security and peace of mind that comes from knowing that you have a solid foundation for your future.

That’s why investors of all sizes and levels of sophistication are turning to high-quality Gold and Silver assets that are designed to be the cornerstone of your wealth building strategy and help you achieve your financial goals.

Chart 3 Gold AUD

Chart 3 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.