Gold and Silver Push Higher on Growing Uncertainty

Financial markets weren’t as frantic last week as they were during the previous week, but the uncertainty stemming from the evolving US tariff strategy remains intense.

The relative stability within global capital markets is fragile, which is bullish for physical Gold and Silver prices.

Gold priced in USD has traded higher during six of the last seven sessions and posted a new all-time high last Thursday at $3357.00, before drifting back to $3326.00 to end the holiday shortened week with a 2.8% gain.

Gold denominated in AUD also reached a new all-time high at $5278.00 last Thursday, but a strong 1.3% rally in the AUD/USD diluted much of the rally pushing the price down to $5205.00 for a 1.2% gain for the week.

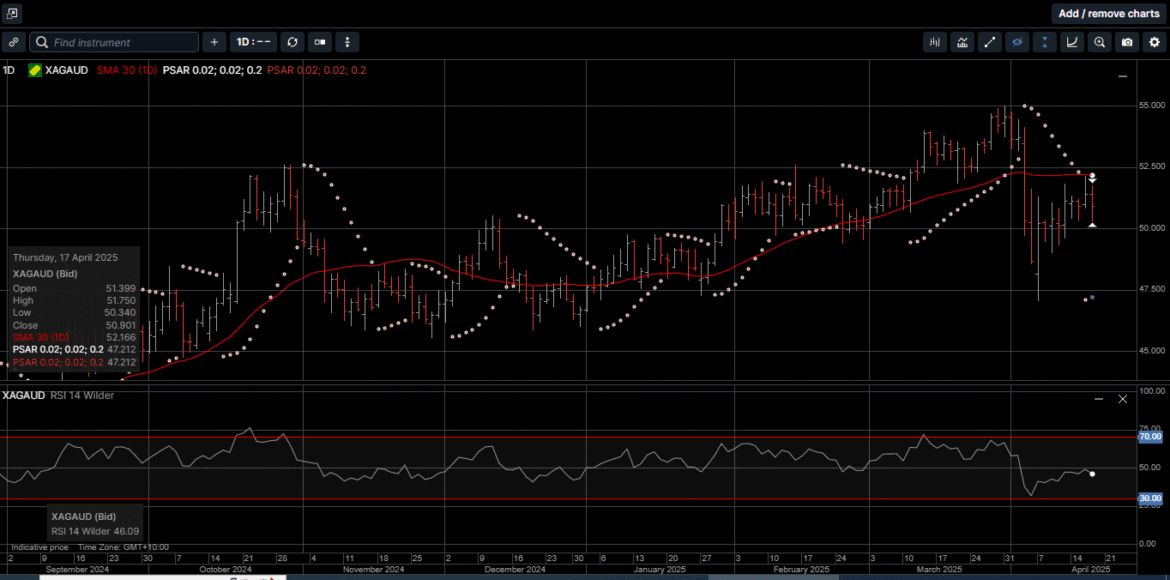

Physical Silver prices consolidated recent gains and look to be building upside technical momentum.

USD based Silver tested upside resistance at the 30-day moving average near $32.75 and finished the week 1.1% higher at $32.55.

Silver priced in AUD was unable to recapture the $52.00 handle and settled the week with a fractional loss at $51.15.

Silver’s relative underperformance saw the Gold versus Silver ratio remain at the elevated level of 103.20, which means it takes 103.20 ounces of Silver to equal the price of one ounce of Gold.

And while the markets weren’t as frenzied as they were the previous week, there is still a widespread sense of uncertainty within the investor community, which continues to underpin Gold and Silver prices.

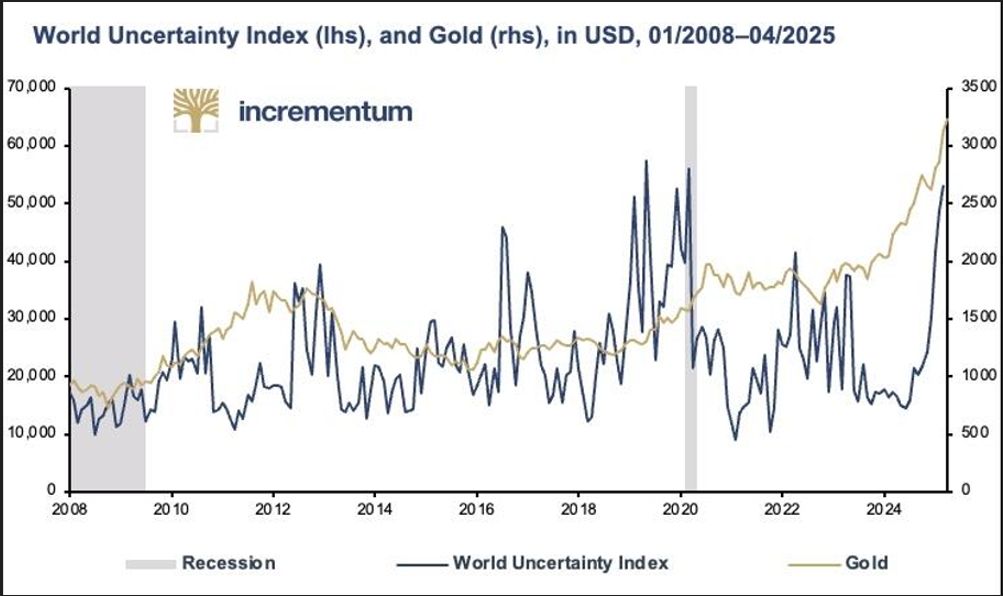

As illustrated on Chart 1, The rise in the World Uncertainty Index is strongly correlated to the extended rally in the price of Gold.

One reason for this uncertainty is that the US Treasury bond market is showing serious cracks.

A sweeping bond selloff (rise in interest rates) has rattled Wall Street as the so-called “safest” asset in the world is starting to look a lot less safe.

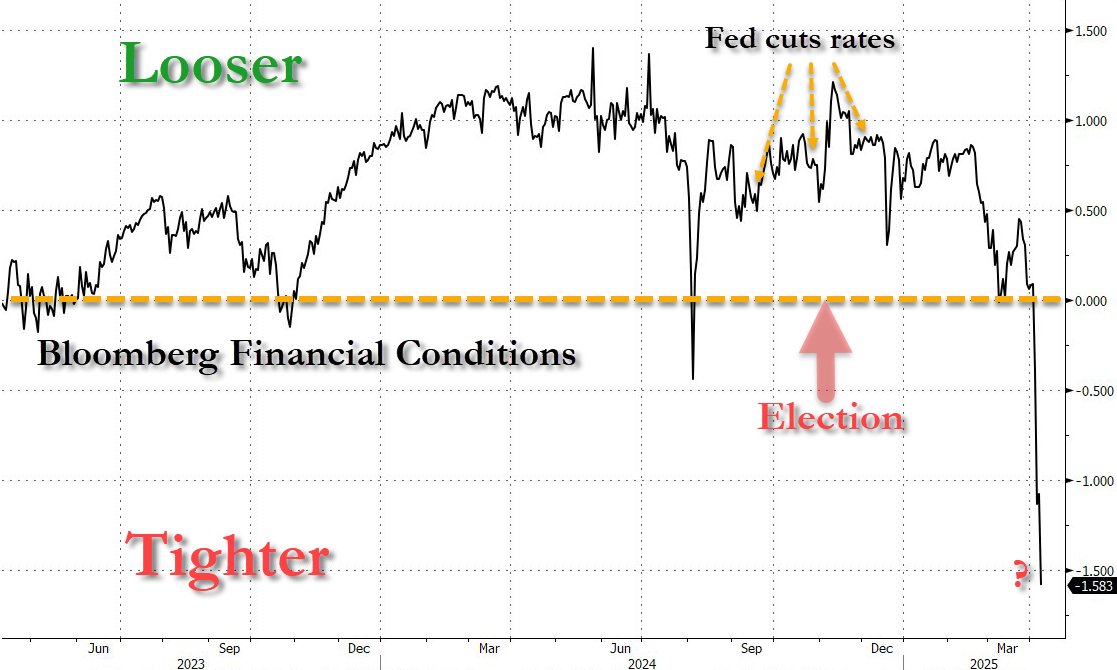

As shown on Chart 2, the most recent 30-year auction was not a positive event.

Demand was weak, and dealers had to clean up the leftovers as yields spiked higher and are now close to a breaking out to multi-year highs.

This rise in US interest rates didn’t come out of the blue.

It’s the result of too much sovereign debt, not enough foreign buyers, and a Federal Reserve (FED) that has paused on rates while other central banks are easing.

As shown on Chart 3, the US FED has held rates unchanged in the 4.25 to 4.50% range since January, which has caused US financial conditions to become extremely tight.

This has raised some questions about the political neutrality of the US central bank.

The FED lowered rates by 50 basis points in September while Wall Street indexes were at all-time highs and GDP growth was projected to be over 3.0%.

Now, after a 20% fall in the SP 500 and GDP growth turning negative, the FED has expressed a firm commitment to keep US rates on hold for the foreseeable future.

The US administration has paused most tariffs at 10%; except for China which is facing a 125% import charge on a wide array of goods.

However, it’s only a 90-day pause. That kind of uncertainty makes investors uneasy.

Meanwhile, the Treasury keeps flooding the market with new paper to cover runaway deficits but demand just isn’t there.

Foreign buyers are backing off, domestic demand has been inconsistent, and tariff-driven inflation risk is still a growing concern.

In other words, when US debt markets start to wobble, hard assets become a more popular alternative.

It seems as though investors and central banks have been waking up to the risk. If even US Treasuries aren’t dependable, where can you turn?

The simple answer is physical Gold and Silver.

Gold and Silver don’t default; they don’t need a central bank or rely on counterparty risk.

That’s why central banks aren’t loading up on US sovereign bonds right now, but instead, they’re buying tons of Gold.

Throughout history, the wisdom for owning Gold and Silver has not centered on the physical metal itself.

Rather, for centuries Gold and Silver have been symbols of financial security and genuine value that allow investors to protect and grow their wealth.

Now is the time to consider adding more physical Gold and Silver to your diversified long-term wealth management strategy.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.