Gold and Silver Burst Higher

Concerns that the precious metals complex was technically overbought proved unfounded as physical Gold and Silver prices rallied sharply higher last week.

Rising geopolitical tensions in the Middle East and Ukraine combined with the looming US tariffs were primary drivers of the extensive safe-haven flows.

For the week, Gold priced in USD spiked to a new all-time high of $3086.00 and ended the week 2.1% higher at $3084.00.

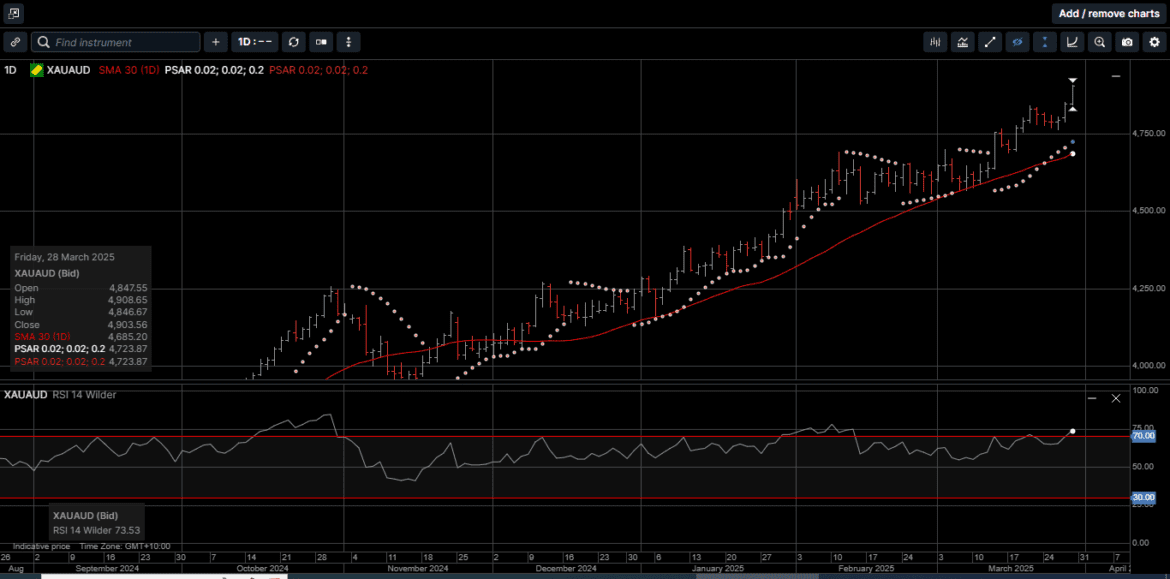

Gold denominated in AUD also reached a new all-time high at $4908.00 before easing lower to close out the week with a 1.8% gain at $4903.00.

On a year-to-date basis, physical Gold in USD and AUD have risen by 17.5% and 15.7%, respectively.

Physical Silver prices were able to clear some longstanding resistance levels and, in the process, outperformed Gold last week.

Silver priced in USD posted a five-month high of $34.60 and closed the week with a 3.4% gain at $34.10.

AUD based Silver rallied to a new all-time high of $54.90 but slipped lower into the weekend to settle 3.3% higher at $54.20.

On a year-to-date basis, USD Silver has risen by a whopping 18%, while AUD Silver has returned 16.1% so far in 2025.

The Gold versus Silver ratio closed out the week at 90.35, which is pretty much the mid-point of the four-month range between 92.40 and 87.05.

That means it takes 90.35 ounces of Silver to equal the price of one ounce of Gold.

In previous newsletters, we have discussed how Silver demand has outpaced Silver production for the last three years and how, on a relative pricing basis, Silver could outperform Gold over the medium term.

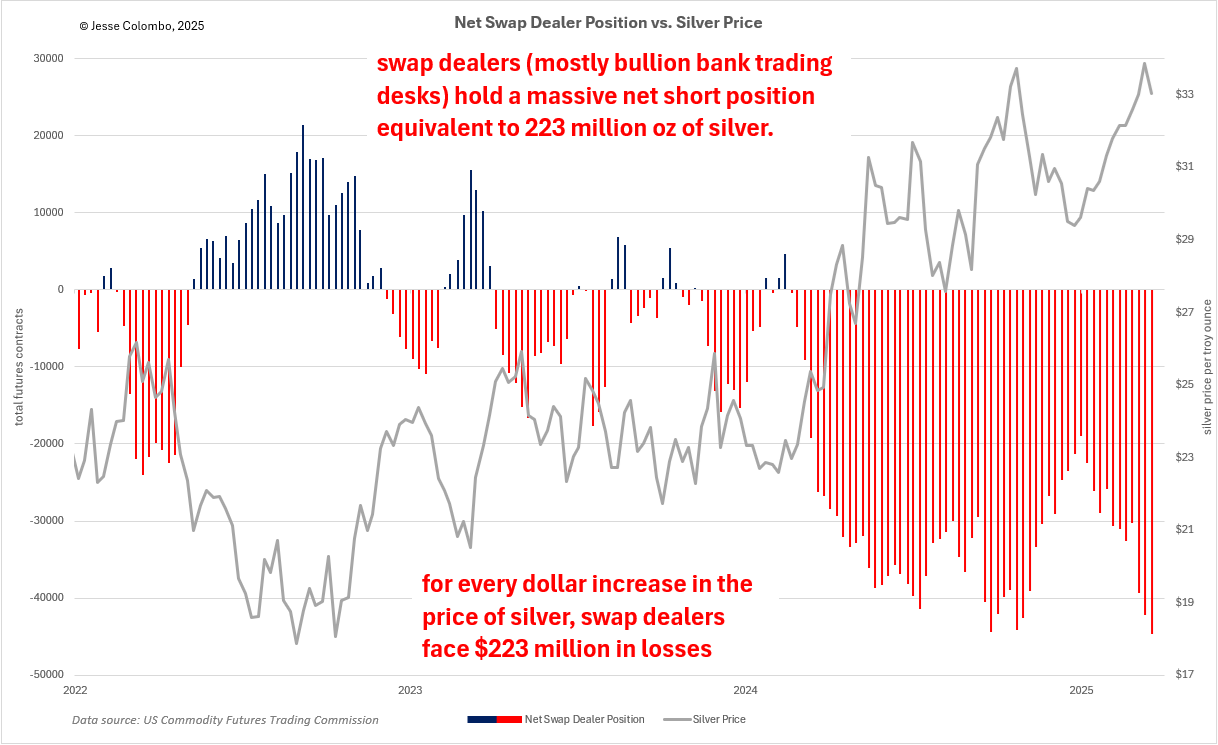

In addition to the supply/demand imbalance, we have noticed a large short Silver position on the COMEX exchange in New York.

As illustrated on Chart 1, swaps dealers have built a 223-million-ounce short position which will either have to be unwound (bought back) or the 223 million ounces of Silver will have to be delivered.

To put this amount into perspective, 223 million ounces is just under 27% of the 837 million ounces of Silver produced during all of 2024.

The idea is that if the swap dealers buy back these short positions in large numbers, there could be a slingshot effect higher in the price of physical Silver.

On the other side of the coin, Gold prices have surged past record highs, central banks are buying aggressively, and yet the US still values its massive Gold reserves at a 50-year-old price.

While Gold trades near $3100.00 per ounce, the US government continues to list its 261.5 million troy ounces at just $42.22 per ounce, which pencils out an official value of only $11 billion instead of its true market worth of over $770 billion.

Revaluing Gold wouldn’t mean selling it off, it would simply reflect its real market value.

A revaluation could immediately strengthen the national balance sheet by adding over $700 billion in assets, improving fiscal positioning without raising taxes or printing more money.

It could also ease debt concerns, giving the Treasury more financial flexibility and reducing the need for excessive borrowing.

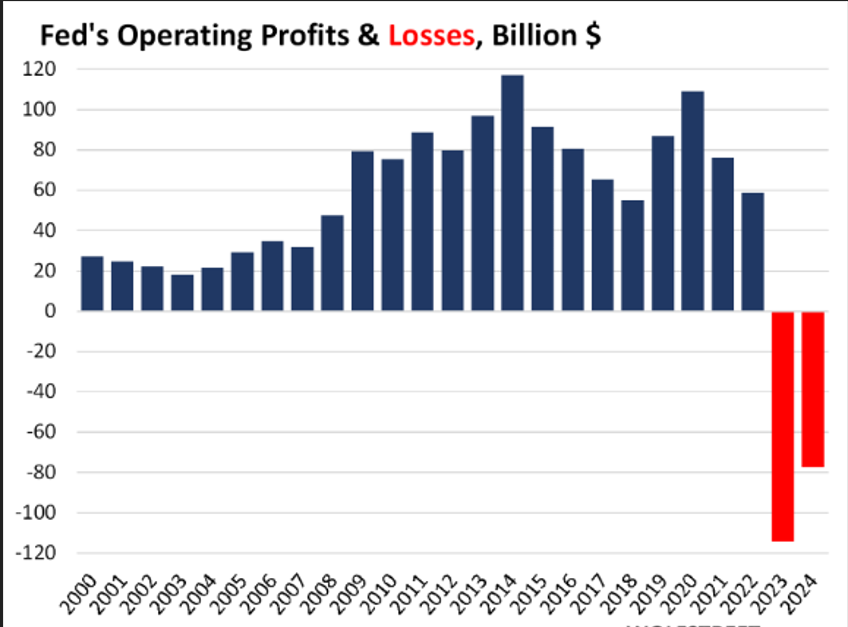

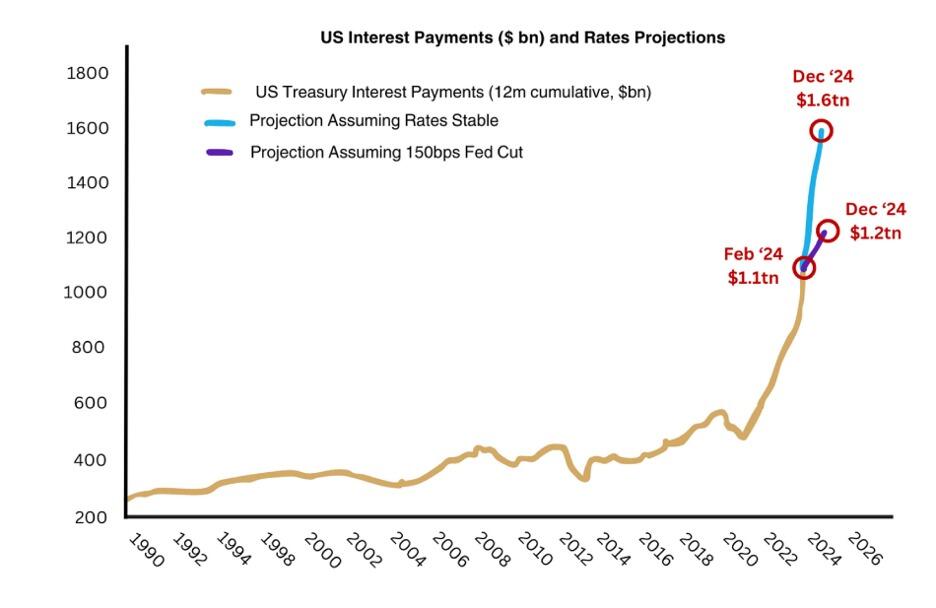

And, as shown on charts 2 and 3, the US FED and the US treasury department could use a financial shot in the arm.

Beyond that, an updated Gold valuation would increase market confidence, reinforcing the strength of US reserves and helping mitigate long-term inflation risks.

By keeping Gold valued at its outdated price, the US government leaves a critical asset underutilized while other nations continue to build their reserves at full market value.

Instead of leveraging real assets at the market price, US lawmakers remain dependent on debt and monetary expansion, which has the potential to further weakening long-term fiscal stability.

Meanwhile, central banks worldwide are diversifying away from the current levels of USD exposure, strengthening their own positions while America clings to an outdated valuation.

As such, a revaluation of the US Gold holdings would be bullish for the price of Gold since it would highlight the yellow metal as a vital asset that plays an important role in the world of global finance.

On balance, both Gold and Silver have outperformed almost every other asset class during the 1st quarter of 2025.

Considering the level of economic uncertainty across the global investment spectrum, this is not a surprise.

There is never a bad time to make a good investment.

Physical Gold and Silver are the benchmark for safe-haven assets and have been used as a store of value for centuries.

Most importantly, adding Gold and Silver to your diversified portfolio offers the potential for long-term growth with the security of tangible, time proven hard assets.

Chart 4 Gold AUD

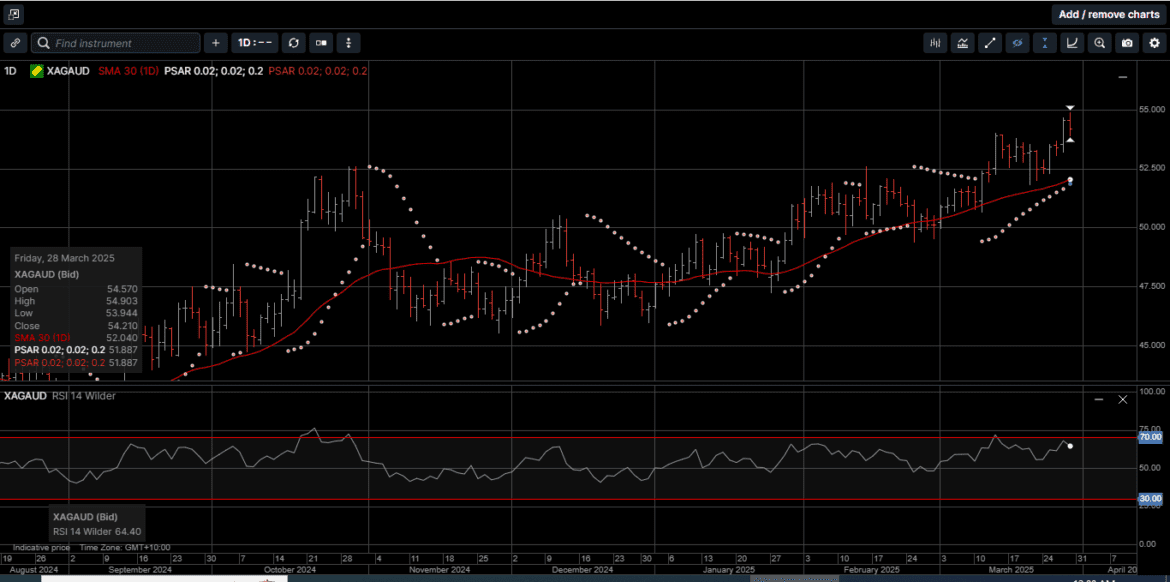

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.