Gold and Silver Rally Into 2025

Not surprisingly, the precious metals complex traded in relatively narrow ranges on thin volumes during the holidays.

However, upside momentum returned last week pushing physical Gold and Silver above the key 30-day moving average levels.

For the week, Gold priced in USD reached a four-week high of $2690.00 on the way to a 1.9% weekly gain.

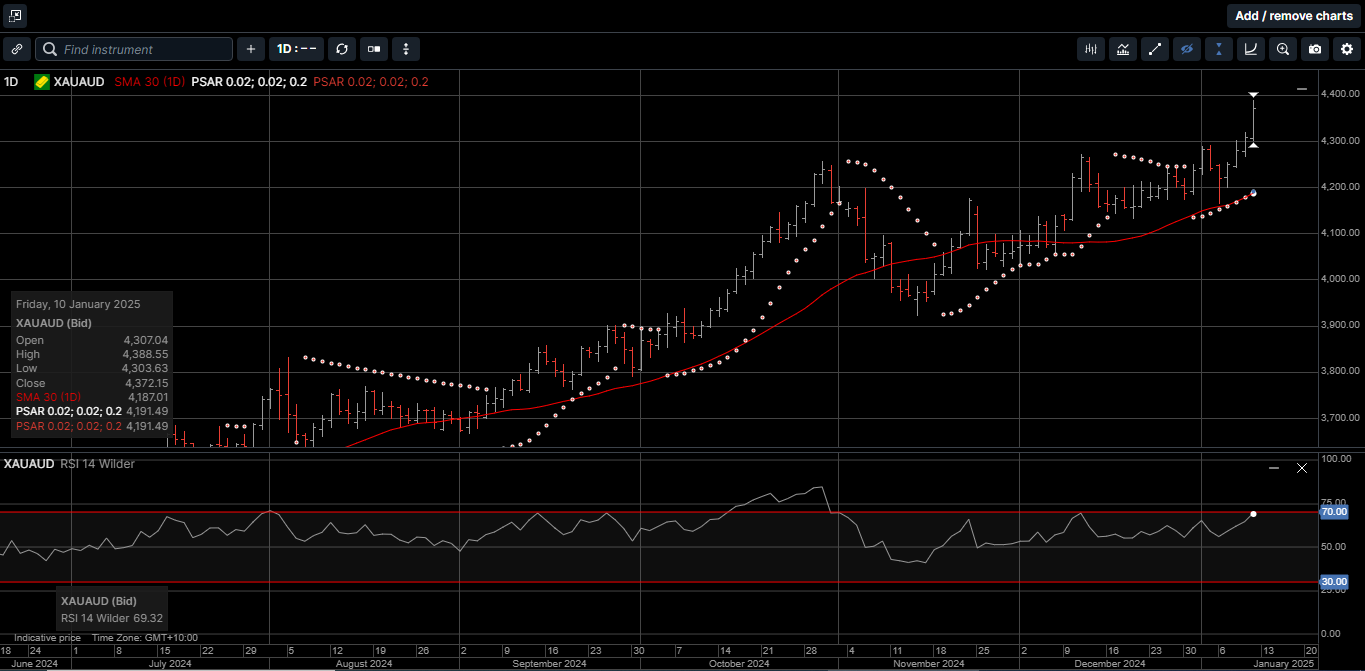

Gold denominated in AUD soared to a new all-time high at $4388.00 and closed the week 3.1% higher.

Physical Silver outperformed Gold as USD Silver tagged the $30.50 level for a 2.7% gain.

AUD Silver traded higher every day last week reaching a five-week high of $49.75 and posted a weekly gain of 3.8%.

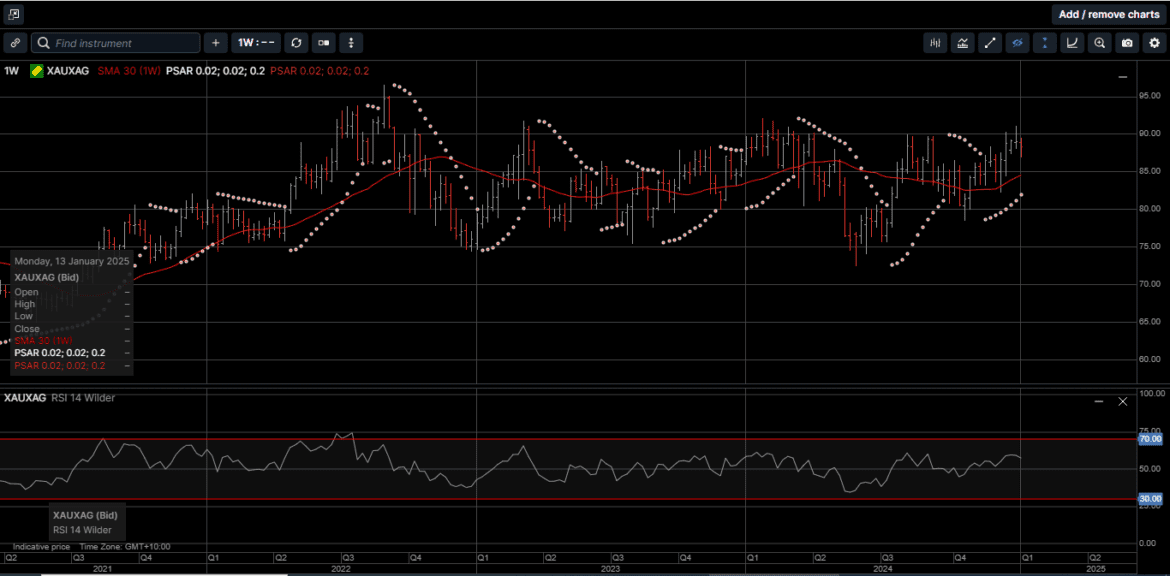

As illustrated on Chart 1, the Gold versus Silver ratio has consolidated after once again finding resistance at the 90.00 level.

This suggests that Silver could outperform Gold in a material way over the medium term and may even return to the 70.00 handle.

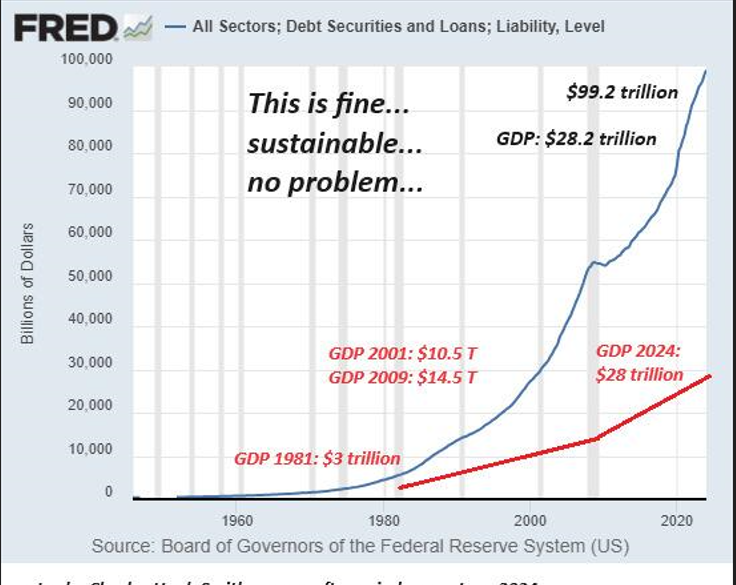

As 2025 begins, economic uncertainty is near an all-time high.

Shifting economic policies, global trade challenges, and persistent pressures from rising debt levels are leaving many retail investors on edge.

As shown on Chart 2, the US Debt to GDP ratio has exploded higher over the last several years and is now unsustainable by any reasonable set of historic economic metrics.

As such, investments like stocks and bonds seem increasingly risky for investors looking to build long-term wealth.

That’s why many investors are turning to Gold and Silver as time-tested alternatives and a secure store of value.

Precious metals outperform during times of economic uncertainty because they’re real, tangible assets which represent the basis of real money.

Unlike cash that loses value through inflation or stocks that can be repriced lower overnight, physical Gold and Silver have been considered a time proven safeguard of wealth for generations.

But even Gold and Silver aren’t immune to short-term price swings, with values sometimes fluctuating in response to global events, simmering geopolitical tensions and economic policy changes.

So, how can provident investors navigate this volatility while still building a strong position in precious metals?

One method is adding to core physical metal holdings when Gold and Silver are trading at the lower part of the broader uptrend established in March of 2023. This is referred to as dollar-cost averaging.

Dollar-cost averaging is a simple investment strategy where investors make regular purchases of an asset, regardless of its current price.

Instead of trying to time the market or make one large purchase, investors can spread out their Gold and Silver investments over time.

This method helps smooth out the effects of daily price volatility and helps investors construct a steady and conservative approach to building wealth with physical precious metals.

Over the course of 2024, USD Gold returned 30%, while AUD Gold gained 41%.

Over the same period of time USD Silver rallied 27.5% and AUD Silver rose by 37%

It’s impossible to say if those impressive returns will be replicated in 2025 but even returns of half that amount would represent a handsome addition to any portfolio.

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.