A Great Year For Gold and Silver

Last week’s long-awaited policy announcement from the US Federal Reserve (FED) was a two bladed sword.

On the one side, the FED lowered their target rate by 25 basis-points to 4.25% to 4.50%, as expected.

On the other side, the FED’s forward guidance suggested that additional easing of rates will not follow the pathway currently expected by financial markets.

Since the announcement last Thursday, there has been plenty of ink spilled about what prompted the FED governors to pare back their interest rate trajectory for next year.

But the bottom line is that the market consensus of 100 basis-points of easing during 2025 has, for now, been recalibrated down to 50 basis-points.

And since global financial markets don’t like surprises, Wall Street stock indexes, Gold, and Silver all traded lower while the USD firmed against the major currency pairs.

For the week, physical Gold priced in USD fell 1% to close at $2622.00. After trading as low as $2582.00 on the FED rate announcement, the recovery back above the $2610.00 level improves the technical tone going into the end of the year.

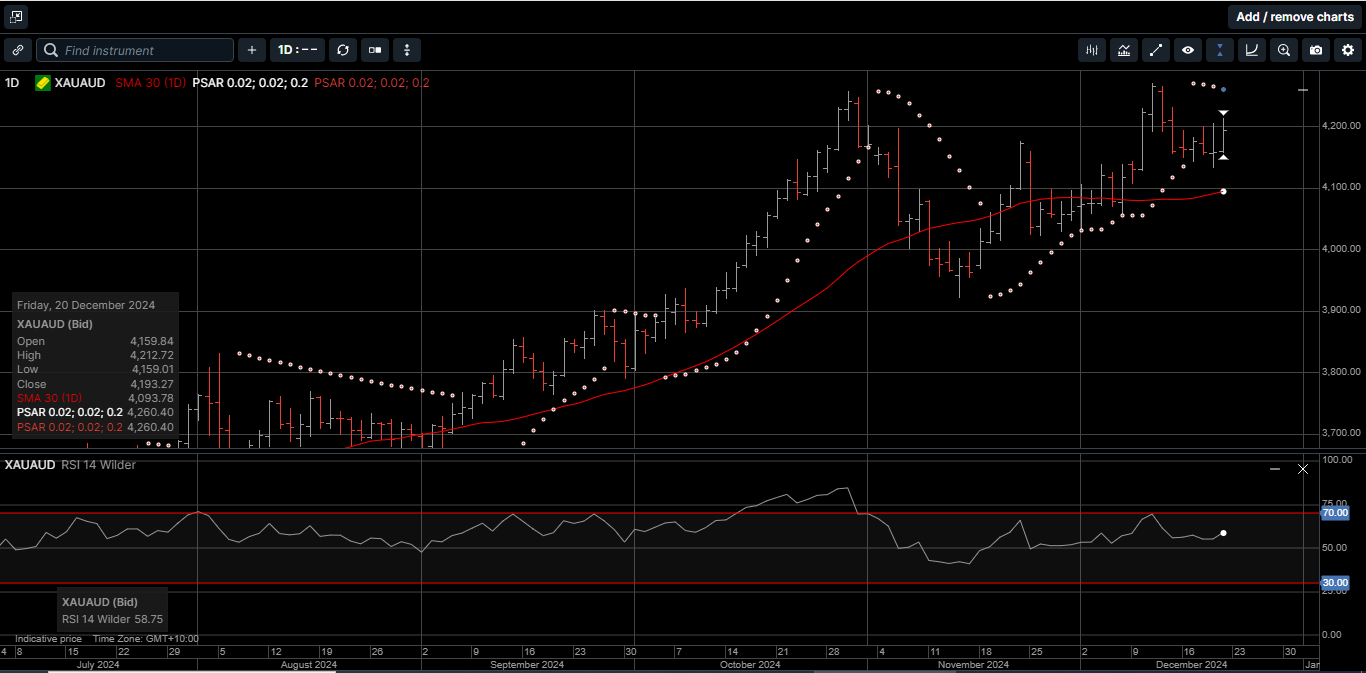

Gold denominated in AUD traded 1% higher to close at $4193.00 as the AUD/USD fell to a 4.5 year low of .6200. AUD Gold has traded above the 30-day moving average everyday since December 6th.

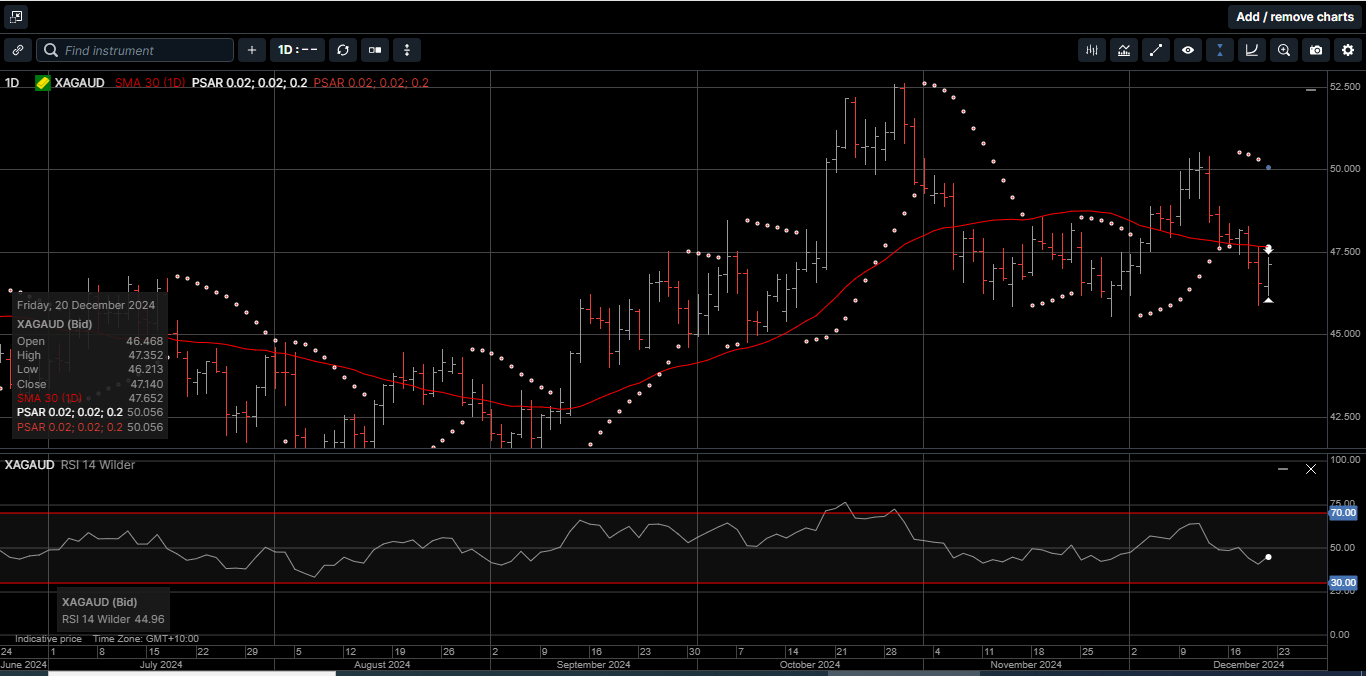

Physical Silver underperformed Gold for the third week in a row.

Silver based in USD fell to a three-month low of $28.70 before recovering into the weekend to post a 3.4% loss at $29.50.

Silver priced in AUD closed 1.7% lower at $47.10 as the weaker AUD limited loses for the week.

As illustrated on Chart 1, the Gold versus Silver ratio posted a triple top at 90.00, which dates back to August 8th and September 9th.

This suggests that physical Silver could outperform physical Gold to start off the New Year.

The reason that Silver fell so much harder than Gold last week relates to the idea that FED will not lower rates as aggressively as they proposed back in September.

The question now is: Will the FED backflip and lower rates faster than they suggested last week?

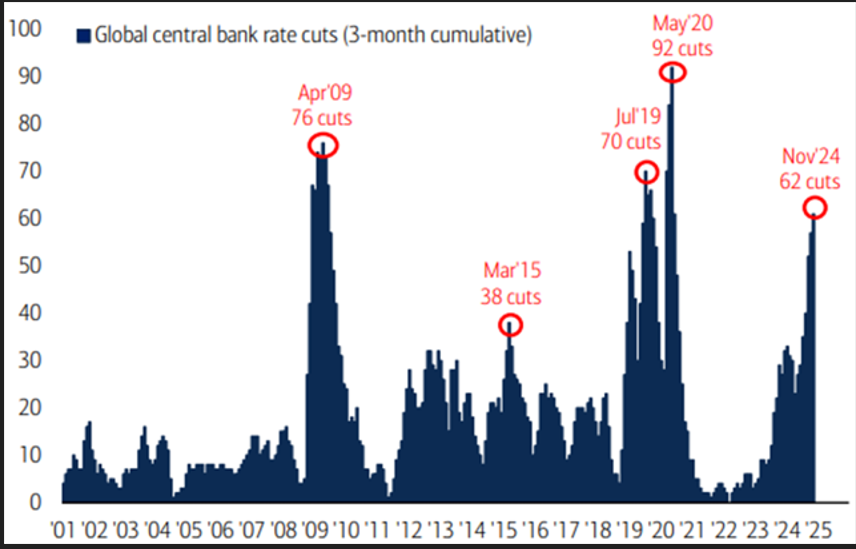

As shown on Chart 2, the last three months have seen a wave of central bank rate cuts which were only surpassed during the financial panic stages of the COVID pandemic in 2020.

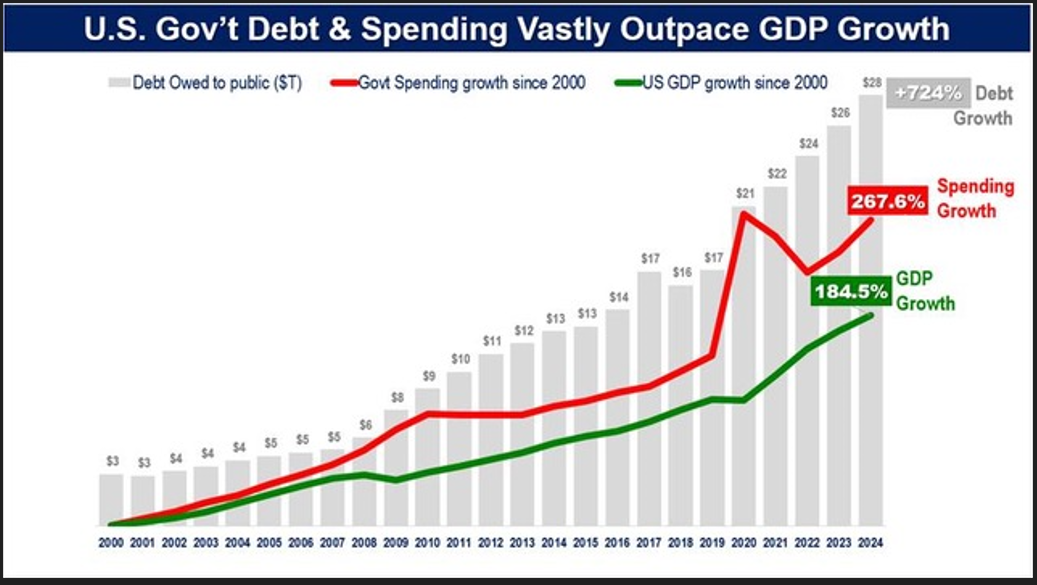

As such, we consider the rapid growth of US Debt relative to GDP, as shown on Chart 3, as a main driver of financial easing in the US, as well as other G-10 economies and a strong reason to continue to accumulate Gold and Silver.

As 2024 comes to a close, many investors are reviewing their portfolios to ensure they’re positioned for the challenges and opportunities of 2025.

The practice of portfolio rebalancing or realigning your asset allocations to meet financial goal is essential for long-term success.

But in today’s uncertain economic environment, one question is becoming more urgent: Are you truly diversified?

While stocks and bonds may form the backbone of many portfolios, relying solely on these traditional assets leaves investors vulnerable to market swings, inflation, and geopolitical events.

This is where hard assets like Gold and Silver are most beneficial. Gold and Silver offer a tangible, time-proven hedge against economic uncertainty.

Precious metals bring unique benefits to any portfolio:

- Hedge Against Inflation: Unlike cash, which loses value over time, precious metals have consistently preserved purchasing power.

- Diversification Beyond Paper Assets: Tangible metals are not tied to stock market performance or central bank policies.

- Safe-Haven Stability: Gold and Silver outperform paper assets during periods of market volatility and economic instability.

By adding regular allocations of Gold and Silver to your portfolio, you create a layer of protection that complements your existing investments.

In fact, rebalancing now can help to ensure your wealth creation strategy is better equipped to withstand the uncertainties of 2025.

We would like to wish all of our clients and subscribers a wonderful holiday season and a prosperous New Year.

Chart 4 – Gold AUD

Chart 5 – Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.