The Gold and Silver Price Equilibrium

The Gold and Silver Price Equilibrium

The high-level price volatility in the precious metals complex since early November gave way to a consolidation pattern last week.

With the next Federal Reserve (FED) meeting scheduled for December 18th, investors could see relatively narrow price ranges for physical Gold and Silver again this week.

Based on the previous market reactions to the US central bank’s interest rate adjustments, it’s possible Gold and Silver prices have reached short-term equilibrium levels and will trade based on incoming data.

Gold priced in USD traded in a narrow 1.8% range and closed down fractionally for the week at $2632.00.

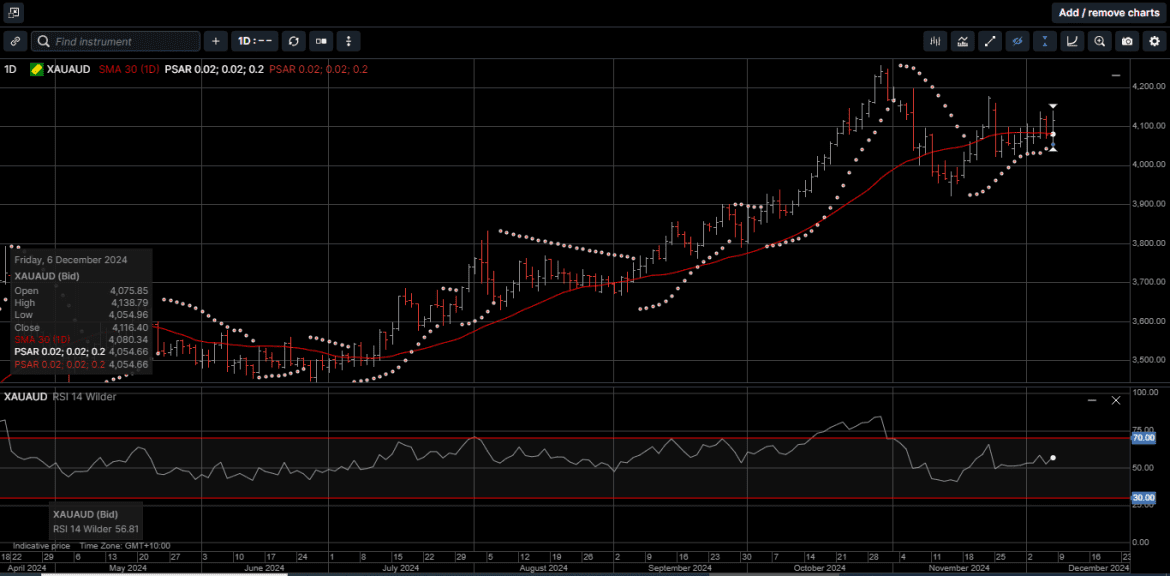

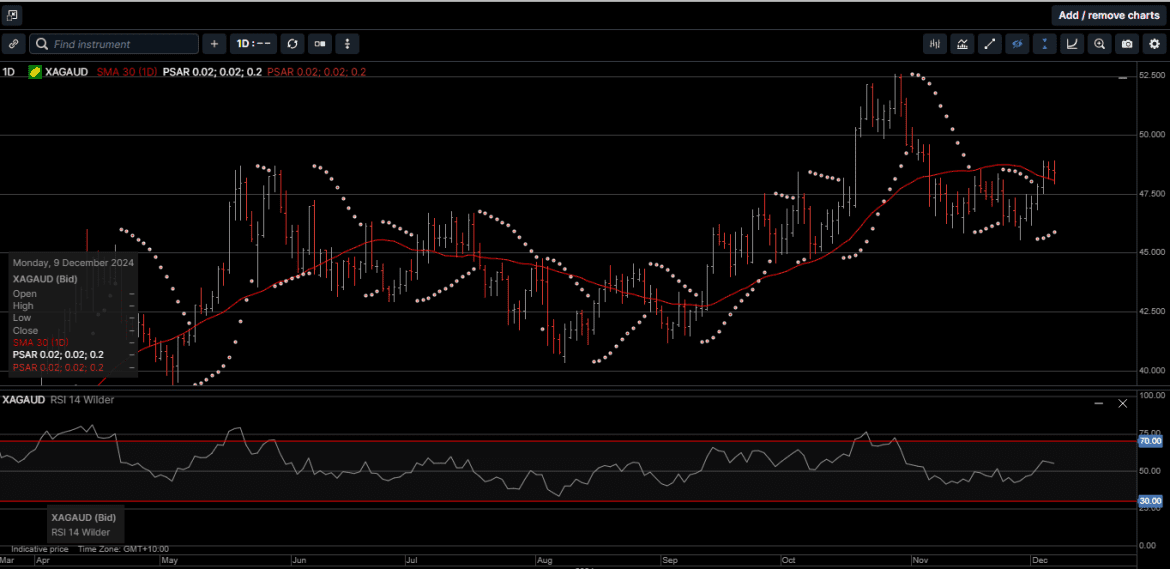

Gold denominated in AUD got a boost from the 1.7% drop in the AUD/USD to reach $4138.00, which is 1.4% higher on the week. The weekly close above the 30-day moving average at $4080.00 improves the technical tone for AUD Gold.

Physical Silver prices outperformed Gold for the first time in three weeks.

Silver priced in USD reached a high of $31.45 to post a weekly gain of 1.1%, while AUD-based Silver tagged a one-month high of $48.90 and closed 3.2% higher on the week.

We pointed out in last week’s newsletter that the Gold vs Silver ratio had pushed against a key resistance level at 86.50, which has signaled a top for most of the year.

The Gold versus Silver ratio dropped 3.8% in favor of Silver last week to 84.10, which suggests Silver could continue to outperform Gold in the near term.

There are four G-10 central banks meeting this week. Of those four, only the RBA is expected to hold rates unchanged.

The Bank of Canada is expected to cut by 50 basis points, the Swiss National Bank is expected to ease by 25 basis points and it’s 50/50 whether the European Central Bank cuts by 25 or 50 basis points.

And while these expected monetary adjustments may trigger an outsized move in the precious metals complex, we believe the more significant price action will be driven by the FED’s policy announcement.

In our opinion, after initiating their easing cycle with a 50-basis point cut in September, the FED is not in a rush to ease aggressively and a 25-basis point cut going into the end of the year is the most likely scenario.

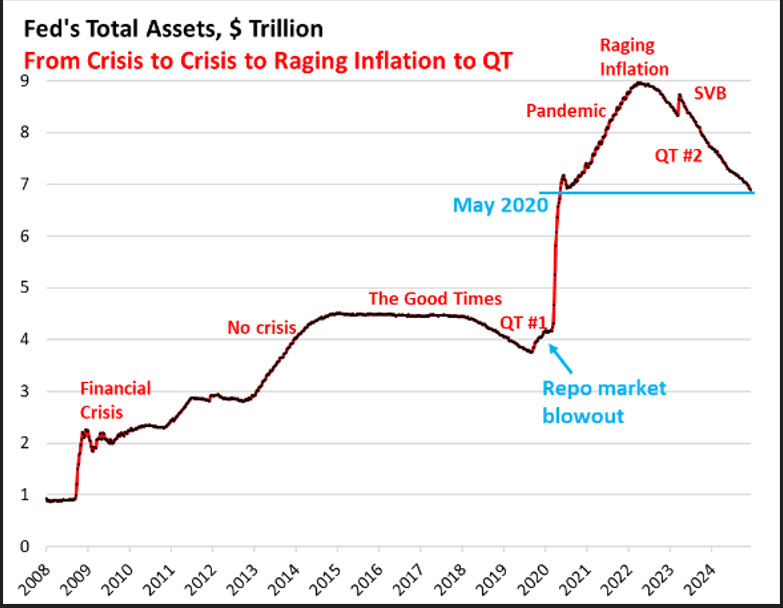

As illustrated on Chart 1, the FED’s balance sheet has been scaled back to the COVID-19 levels without materially tightening overall US credit conditions.

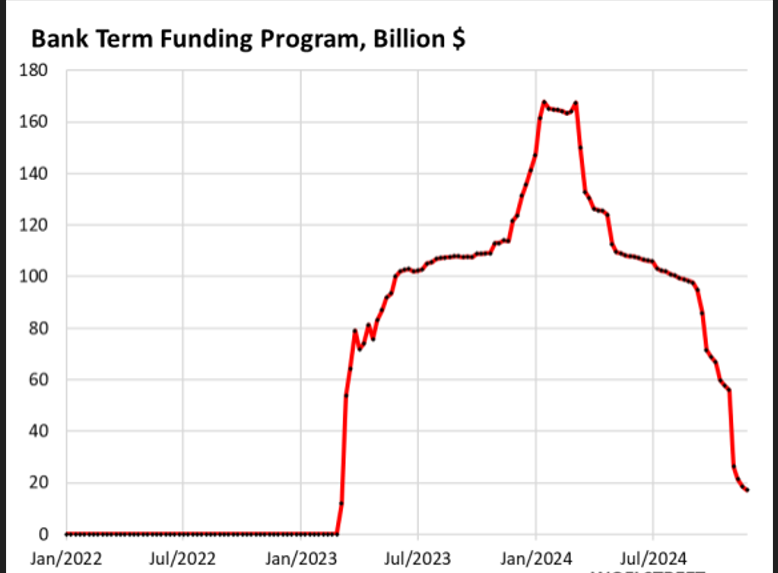

Looking at Chart 2 shows that over $140 billion of the FED’s balance sheet reduction is from the unwinding of the Bank Term Funding Program (BTFP).

You may remember that the BTFP was quickly thrown together in mid-March of 2023 after Silicon Valley Bank and Signature Bank both were declared insolvent during the first week of March 2023.

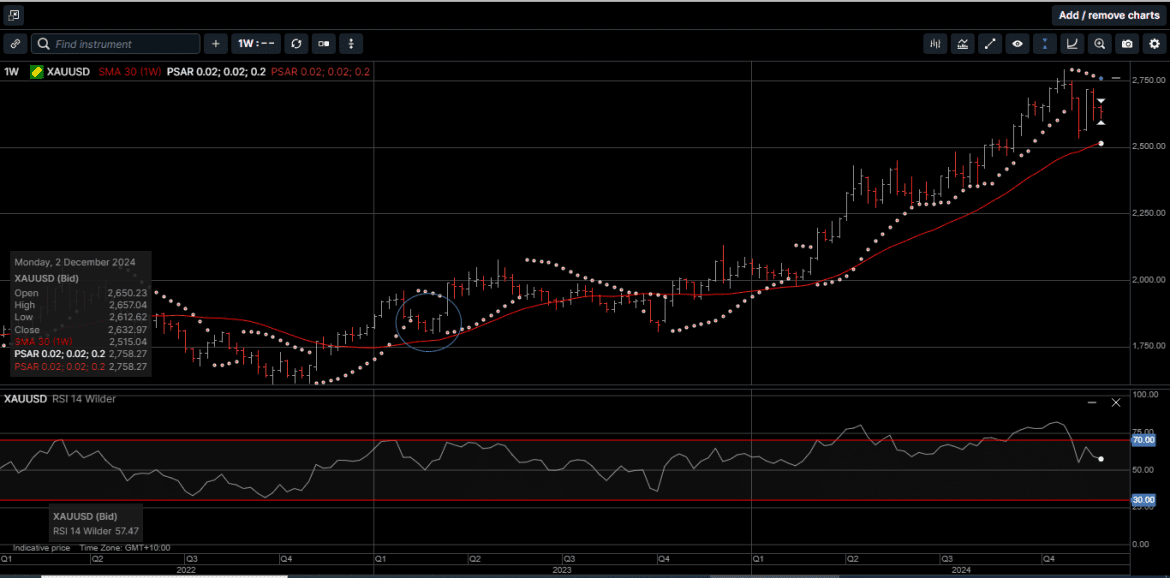

Chart 3 is a weekly price chart of Gold. The circled section is March of 2023, which based on our time-cycle charting, is the beginning of the strong rallies in Gold and Silver.

Looking at the precious metals from a broader timeframe, Gold and Silver prices have been pushing consistently higher, shattering records and defying expectations over the last 12 months.

Gold is now experiencing its strongest rally in over 40 years and Silver is on course to have its best year since 2008.

On a year-to-date basis, USD Gold is up 28%, AUD Gold is 35% higher, USD Silver has risen by 33.5% and AUD Silver has returned an eyewatering 40.5% since the beginning of 2024.

Several factors are contributing to this influx of investor interest, which we’ve designated the Four Pillars of Hard Asset Support.

Geopolitical Tensions: The ongoing Russian-Ukrainian conflict and rising tensions in the Middle East have heightened global uncertainties, driving investors towards safe-haven assets like Gold and Silver.

Interest Rate Cuts: The U.S. Federal Reserve’s aggressive interest rate cut and expectations of further easing from the US and Europe have made Gold and Silver more attractive by reducing the opportunity cost of holding it.

Weakening US Dollar: The USD is largely unchanged since October of 2023, which has made Gold and Silver cheaper for holders of other currencies, further stimulating demand.

Economic Uncertainties: Lingering concerns about global economic growth, soaring deficits and inflation have also boosted the appeal for Gold and Silver as a hedge against economic instability.

The long-term outlook for hard assets remains positive, with several factors likely to sustain the upward trajectory of prices into 2025 and beyond.

As such, the ongoing investor interest in Gold and Silver is a testament to the enduring appeal of these precious metals.

Gold and Silver’s unique combination of safety, liquidity and monetary value makes them an attractive investment option in times of economic uncertainty.

As the global economy navigates a complex and uncertain landscape, Gold and Silver’s role as a safe-haven asset and a store of value is likely to become even more prominent for investors looking for a long-term wealth creation strategy.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.