Gold and Silver Prices Surge: Strong Rally Amid Rising US Dollar and Interest Rates

Gold and Silver Prices Surge: Strong Rally Amid Rising US Dollar and Interest Rates

The post-election long liquidation in the precious metals complex looks to have run its course.

And even though physical Gold and Silver prices broke down through long held support levels earlier this month, last week’s strong rally has turned the technical picture back to a positive outlook.

Gold based in USD traded higher everyday last week, posted two daily sessions with double digit gains and finished the week 6.0% higher at $2715.00, which was the strongest weekly performance since March of 2023.

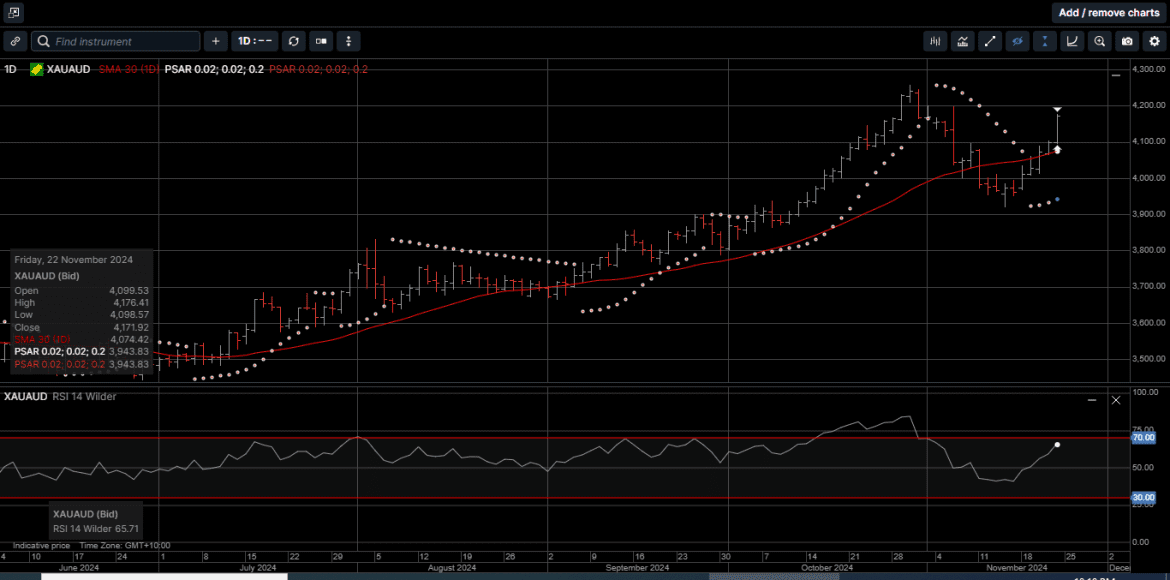

Gold denominated in AUD also rose everyday last week gaining over $200.00 on the way to a 5.2% return for the week at $4170.00.

Physical Silver prices were unable to match the rally in Gold but still reclaimed key price levels on the daily charts.

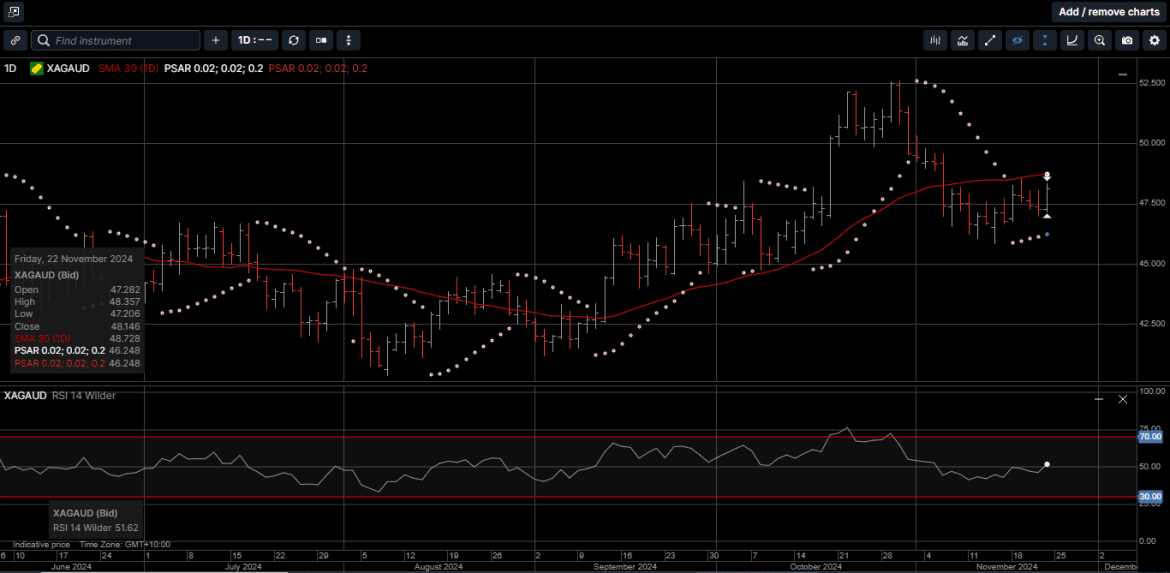

Silver priced in USD closed the week 3.6% higher at $31.35, while AUD-based Silver picked up 3.1% for the week to close at $48.15.

The most impressive part of last week’s rally in Gold and Silver was that it occurred while the US Dollar and US interest rates traded higher.

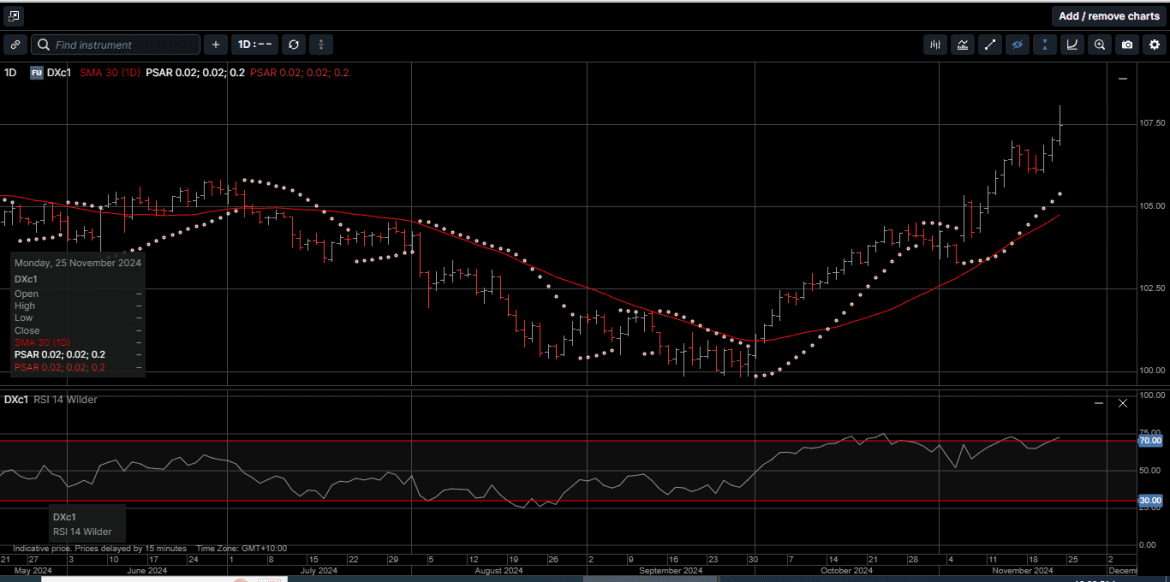

As illustrated on Chart 1, the USD Q4 rally continued last week. The Dollar Index has risen in the first eight weeks of the fourth quarter, gaining a little more than 7%.

Half of the G10 currencies (the Euro, the Swedish krona, the Norwegian and Danish krone, and New Zealand dollar) fell to new lows for the year versus the USD last week.

Part of the stronger USD story is the paring of Federal Reserve rate cut expectations.

The Fed Funds derivatives market no longer has even 50 basis points of easing discounted between now and the middle of next year.

As such, the effective Fed Funds rate at the end of next year is now seen near 3.90%. It was below 3.00% at the end of September.

The divergence between the US economic performance and most of the other high-income countries is stark and this is even before the next administration’s tariffs, tax cuts, and de-regulation.

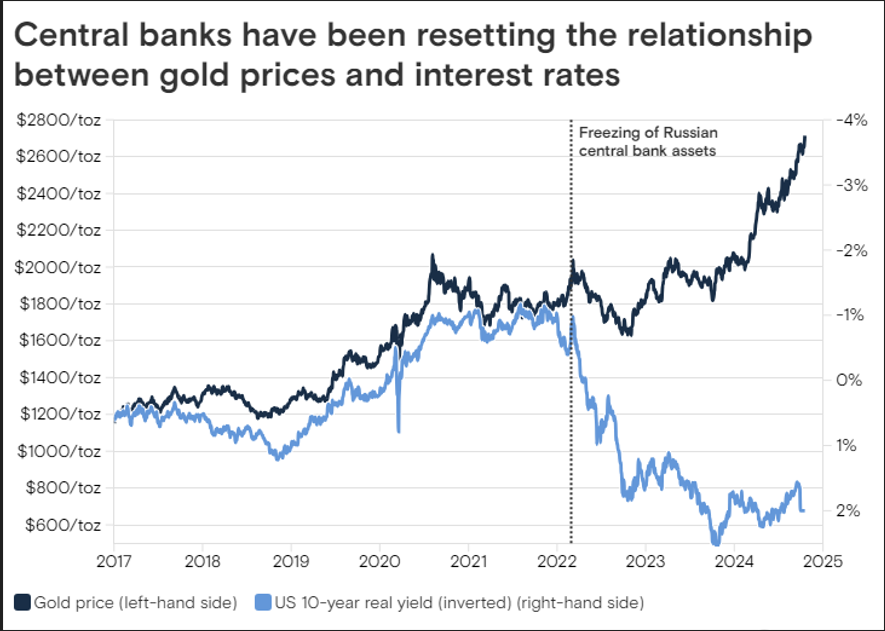

We have mentioned in the past that changes in the geopolitical landscape have diluted the long-held correlation that Gold and Silver prices trade lower when the USD trades higher.

As shown on Chart 2, the Russian invasion of Ukraine in February of 2022, and the subsequent freezing of Russian assets, marked the beginning of the divergence between US interest rates and the upward trajectory in Gold and Silver prices.

Further, it wasn’t long after sanctions were placed against Russia that central banks increased their purchases of Gold, which lifted both Gold and Silver prices.

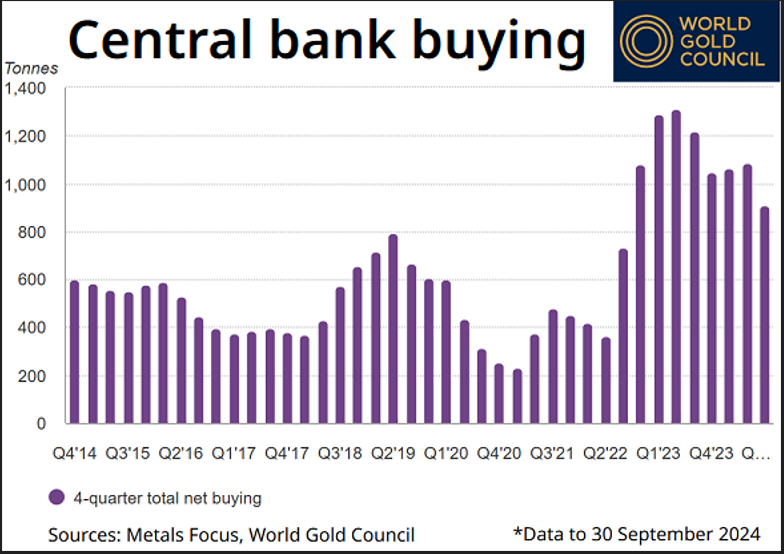

As shown on Chart 3, central banks have been buying Gold at a record pace over the past two years.

Gold has been an essential component in the financial reserves of nations for centuries, and its appeal is showing no sign of diminishing, with central banks set to be net purchasers of Gold once again this year.

In fact, central banks now hold more than 35,000 metric tons of the yellow metal, or about 20% of all the Gold ever mined.

One of Gold’s primary roles for central banks is to diversify their reserves. The banks are responsible for their nations’ currencies, but these can be subject to swings in value depending of the perceived strength or weakness of the underlying economy.

In times of need, central banks may be forced to print more money. This increase in money supply may be necessary to stave off economic turmoil but at the cost of devaluing the currency.

Gold, by contrast, is a finite physical commodity whose supply can’t easily be added to. As such, it is a natural hedge against inflation.

Since Gold carries no credit or counterparty risks, it serves as a source of security in a country, and in all economic environments, making it one of the most crucial reserve assets worldwide.

The US holds the most Gold reserves, with over 8,100 tons, which equates to almost 78 percent of its total foreign reserves.

That’s more than double Germany’s holdings of more than 3,300 tons, which makes it second on the list and equates to about 74 percent of its reserves.

Concerns about the risk of financial sanctions is likely one of the reasons central banks have increased their Gold reserves.

Emerging market central bank purchases of Gold have risen measurably since the freezing of Russian central bank assets in 2022, following Russia’s invasion of Ukraine.

From the perspective of an individual investor, the pace at which Gold and Silver have recovered from the recent price correction should underscore the importance of holding hard assets as a long-term wealth creation strategy.

Gold and Silver are pure forms of money which are secure, safe-haven assets and a time proven store of value.

Chart 4 – Gold AUD

Chart 5 – Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.